Pitney Bowes 2008 Annual Report Download - page 64

Download and view the complete annual report

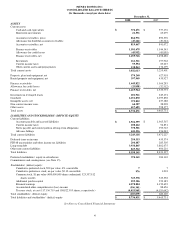

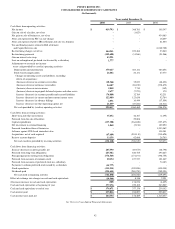

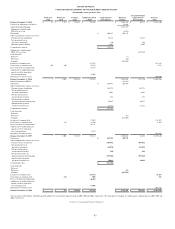

Please find page 64 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. PITNEY BOWES INC.

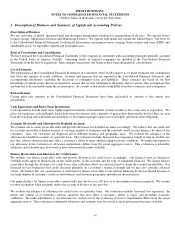

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

45

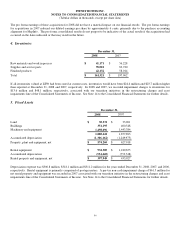

Inventories

Inventories are stated at the lower of cost or market. Cost is determined on the last-in, first-out (LIFO) basis for most U.S. inventories,

and on the first-in, first-out (FIFO) basis for most non-U.S. inventories.

Other Current Assets and Prepayments

Other current assets and prepayments include postage meter receivables billed in advance of $60.0 million and $57.0 million,

respectively, at December 31, 2008 and 2007.

Fixed Assets and Depreciation

Property, plant and equipment and rental equipment are stated at cost and depreciated principally using the straight-line method over

their estimated useful lives. The estimated useful lives of depreciable fixed assets are as follows: buildings, up to 50 years; plant and

equipment, 3 to 15 years; and computer equipment, 3 to 5 years. Major improvements which add to productive capacity or extend the

life of an asset are capitalized while repairs and maintenance are charged to expense as incurred. Leasehold improvements are

amortized over the shorter of the estimated useful life or their related lease term.

Fully depreciated assets are retained in fixed assets and accumulated depreciation until they are removed from service. In the case of

disposals, assets and related accumulated depreciation are removed from the accounts, and the net amounts, less proceeds from

disposal, are included in income.

Capitalized Software Development Costs

We capitalize certain costs of software developed for internal use in accordance with Statement of Position No. 98-1, Accounting for

the Costs of Computer Software Developed or Obtained for Internal Use. Capitalized costs include purchased materials and services,

payroll and payroll-related costs and interest costs. The cost of internally developed software is amortized on a straight-line basis over

its estimated useful life, principally 3 to 10 years.

We capitalize software development costs related to software to be sold, leased, or otherwise marketed in accordance with Statement

of Financial Accounting Standards (SFAS) No. 86, Accounting for the Costs of Computer Software to Be Sold, Leased, or Otherwise

Marketed. Software development costs are expensed as incurred until technological feasibility has been established, at which time

such costs are capitalized until the product is available for general release to the public. Capitalized software development costs

include purchased materials and services, payroll and payroll-related costs attributable to programmers, software engineers, quality

control and field certifiers, and interest costs. Capitalized software development costs are amortized over the estimated product useful

life, principally 3 to 5 years, using the greater of the straight-line method or the ratio of current product revenues to total projected

future revenues. Other assets on our Consolidated Balance Sheets include $19.6 million and $21.6 million of capitalized software

development costs at December 31, 2008 and 2007, respectively. The Consolidated Statements of Income include the related

amortization expense of $6.1 million, $3.9 million, and $1.6 million for the years ended December 31, 2008, 2007, and 2006,

respectively. Total software development costs capitalized in 2008 and 2007 were $7.1 million and $10.1 million, respectively.

Research and Development Costs

Research and product development costs not subject to SFAS No. 86 are expensed as incurred. These costs primarily include

personnel related costs.

Business Combinations

We account for business combinations using the purchase method of accounting which requires that the assets acquired and liabilities

assumed be recorded at the date of acquisition at their respective fair values. Goodwill represents the excess of the purchase price

over the estimated fair values of net tangible and intangible assets acquired in business combinations. Goodwill is tested for

impairment on an annual basis or as circumstances warrant. We estimate the fair value of intangible assets primarily using a cost,

market and income approach. Intangible assets with finite lives acquired under business combinations are amortized over their

estimated useful lives, principally 3 to 15 years. Customer relationship intangibles are generally amortized using an accelerated

attrition method. All other intangibles are amortized on a straight-line method. See Note 6 to the Consolidated Financial Statements.