Pitney Bowes 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 27

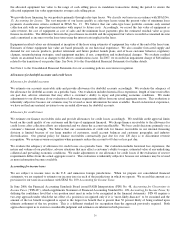

In September 2006, the FASB issued Statement of Financial Accounting Standards (“SFAS”) No. 157, Fair Value Measurements

(“SFAS 157”), to define how the fair value of assets and liabilities should be measured in accounting standards where it is allowed or

required. In addition to defining fair value, the Statement established a framework within GAAP for measuring fair value and

expanded required disclosures surrounding fair value measurements. In February 2008, the FASB issued FASB Staff Position (FSP).

FAS 157-2, Effective Date of FASB Statement No. 157, which delayed the effective date by one year for all nonfinancial assets and

nonfinancial liabilities, except those that are recognized or disclosed at fair value in the financial statements on a recurring basis. In

October 2008, the FASB issued FSP FAS 157-3, Determining the Fair Value of a Financial Asset When the Market for That Asset Is

Not Active. This FSP is effective immediately and includes those periods for which financial statements have not been issued. We

adopted this Statement for financial assets and financial liabilities on January 1, 2008, and the adoption did not have a material impact

on our financial position, results of operations, or cash flows. We do not expect the adoption of this Statement for nonfinancial items

effective January 1, 2009 to have a material impact on our financial position, results of operations, or cash flows. We currently do not

have any financial assets that are valued using inactive markets, and as such are not impacted by the issuance of FSP 157-3. See Note

19 to the Consolidated Financial Statements for additional discussion on fair value measurements.

In September 2006, the FASB issued SFAS No. 158, Employers’ Accounting for Defined Benefit Pension and Other Postretirement

Plans an amendment of FASB Statements No. 87, 88, 106 and 132(R) (“SFAS 158”), which required recognition of the overfunded or

underfunded status of pension and other postretirement benefit plans on the balance sheet. Under SFAS 158, gains and losses, prior

service costs and credits, and any remaining transition amounts under SFAS No. 87 and SFAS No. 106 that have not yet been

recognized through net periodic benefit cost were recognized in accumulated other comprehensive income, net of tax effects, until

they are amortized as a component of net periodic cost. Our adoption of the provisions of SFAS 158 reduced stockholders’ equity by

$297 million at December 31, 2006. SFAS 158 did not affect our results of operations or cash flows.

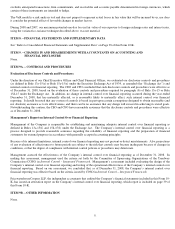

In December 2007, the FASB issued SFAS No. 141(R), Business Combinations (“SFAS 141(R)”). SFAS 141(R) establishes

principles and requirements for how a company (a) recognizes and measures in their financial statements the identifiable assets

acquired, the liabilities assumed, and any noncontrolling interest (previously referred to as minority interest); (b) recognizes and

measures the goodwill acquired in a business combination or a gain from a bargain purchase; and (c) determines what information to

disclose to enable users of the financial statements to evaluate the nature and financial effects of a business combination. SFAS

141(R) requires fair value measurements at the date of acquisition, with limited exceptions specified in the Statement. Some of the

major impacts of this new standard include expense recognition for transaction costs and restructuring costs. SFAS 141(R) is effective

for fiscal years beginning on or after December 15, 2008 and will be applied prospectively. We do not expect the adoption of this

Statement to have a material impact on our financial position, results of operations, or cash flows.

In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in Consolidated Financial Statements, an amendment of

ARB No. 51 (“SFAS 160”). SFAS 160 addresses the accounting and reporting for the outstanding noncontrolling interest (previously

referred to as minority interest) in a subsidiary and for the deconsolidation of a subsidiary. It also establishes additional disclosures in

the consolidated financial statements that identify and distinguish between the interests of the parent’s owners and of the

noncontrolling owners of a subsidiary. SFAS 160 requires changes in ownership interest that do not result in deconsolidation to be

accounted for as equity transactions. This Statement requires that a parent recognize a gain or loss in net income when a subsidiary is

deconsolidated. This gain or loss is measured using the fair value of the noncontrolling equity investment. This Statement is effective

for fiscal years beginning on or after December 15, 2008. SFAS 160 requires retroactive adoption of the presentation and disclosure

requirements for existing minority interests. All other requirements of SFAS 160 are applied prospectively. We do not expect the

adoption of this Statement to have a material impact on our financial position, results of operations, or cash flows.

In March 2008, the FASB issued SFAS No. 161, Disclosures about Derivative Instruments and Hedging Activities (“SFAS 161”).

SFAS 161 requires enhanced disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative instruments

and related hedged items are accounted for under SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities, and

its related interpretations, and (c) how derivative instruments and related hedged items affect an entity’s financial position, financial

performance, and cash flows. This Statement is effective for financial statements issued for fiscal years and interim periods beginning

after November 15, 2008. This Statement encourages, but does not require, comparative disclosures for earlier periods at initial

adoption. The adoption of this Statement will require us to present currently disclosed information in a tabular format and will also

expand our disclosures concerning where derivatives are reported on the balance sheet and where gains/losses are recognized in the

results of operations. The Company will comply with the disclosure requirements of this Statement beginning in the first quarter of

2009.

In April 2008, the FASB issued FSP FAS 142-3, Determination of the Useful Life of Intangible Assets (“FSP FAS 142-3”). FSP FAS

142-3 removed the requirement of SFAS No. 142, Goodwill and Other Intangible Assets (“SFAS 142”), for an entity to consider,

when determining the useful life of an acquired intangible asset, whether the intangible asset can be renewed without substantial cost

or material modification to the existing terms and conditions associated with the intangible asset. FSP FAS 142-3 replaces the

previous useful life assessment criteria with a requirement that an entity considers its own experience in renewing similar

arrangements. If the entity has no relevant experience, it would consider market participant assumptions regarding renewal. This