Pitney Bowes 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

62

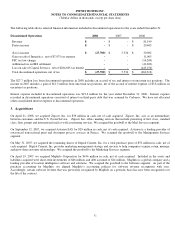

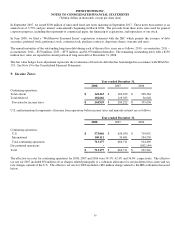

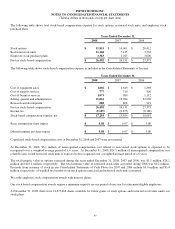

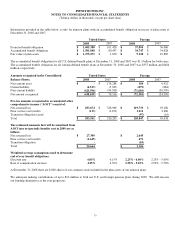

2008 2007

Balance at beginning of year $ 398,878 $ 356,063

Increases from prior period positions 21,623 28,762

Decreases from prior period positions (8,899) (20,063)

Increases from current period positions 33,028 61,778

Decreases from current period positions - -

Decreases relating to settlements with tax authorities (7,426) (2,165)

Reductions as a result of a lapse of the applicable statute of limitations (3,040) (25,497)

Balance at end of year $ 434,164 $ 398,878

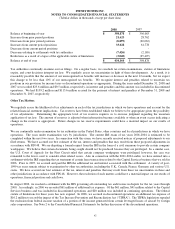

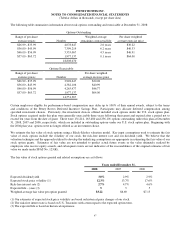

Tax authorities continually examine our tax filings. On a regular basis, we conclude tax return examinations, statutes of limitations

expire, and court decisions interpret tax law. We regularly assess tax uncertainties in light of these developments. As a result, it is

reasonably possible that the amount of our unrecognized tax benefits will increase or decrease in the next 12 months, but we expect

this change to be less than 10% of our unrecognized tax benefits. We recognize interest and penalties related to uncertain tax

positions in our provision for income taxes or discontinued operations as appropriate. During the years ended December 31, 2008 and

2007 we recorded $25.6 million and $9.5 million, respectively, in interest and penalties and this amount was included in discontinued

operations. We had $139.2 million and $113.6 million accrued for the payment of interest and penalties at December 31, 2008 and

December 31, 2007, respectively.

Other Tax Matters

We regularly assess the likelihood of tax adjustments in each of the tax jurisdictions in which we have operations and account for the

related financial statement implications. Tax reserves have been established which we believe to be appropriate given the possibility

of tax adjustments. Determining the appropriate level of tax reserves requires us to exercise judgment regarding the uncertain

application of tax law. The amount of reserves is adjusted when information becomes available or when an event occurs indicating a

change in the reserve is appropriate. Future changes in tax reserve requirements could have a material impact on our results of

operations.

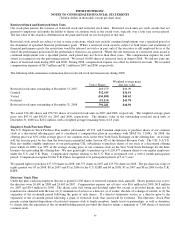

We are continually under examination by tax authorities in the United States, other countries and local jurisdictions in which we have

operations. The years under examination vary by jurisdiction. The current IRS exam of tax years 2001-2004 is estimated to be

completed within the next two years. In connection with this exam, we have recently received notices of proposed adjustments to our

filed returns. We have accrued our best estimate of the tax, interest and penalties that may result from these proposed adjustments in

accordance with FIN 48. We are disputing a formal request from the IRS in the form of a civil summons to provide certain company

workpapers. We believe that certain documents being sought should not be produced because they are privileged. In a similar case,

the U.S. Court of Appeals for the First Circuit ruled that certain company workpapers were privileged, however, the case was

remanded to the lower court to consider other related issues. Also in connection with the 2001-2004 audits, we have entered into a

settlement with the IRS regarding the tax treatment of certain lease transactions related to the Capital Services business that we sold in

2006. Prior to 2007, we accrued and paid the IRS the additional tax and interest associated with this settlement. A variety of post-

1999 tax years remain subject to examination by other tax authorities, including the U.K., Canada, France, Germany and various U.S.

states. We have accrued our best estimate of the tax, interest and penalties that may result from these tax uncertainties in these and

other jurisdictions in accordance with FIN 48. However, the resolution of such matters could have a material impact on our results of

operations, financial position and cash flows.

In August 2006, we reached a settlement with the IRS governing all outstanding tax audit issues in dispute for the tax years through

2000. Accordingly, in 2006 we recorded $61 million of additional tax expense. Of the $61 million, $41 million related to the Capital

Services business and was included in discontinued operations and $20 million was included in continuing operations. The federal

statute of limitations for these years has now expired. In 2006, we accrued in discontinued operations an additional tax expense of

$16.2 million to record the impact of the Tax Increase Prevention and Reconciliation Act (“TIPRA”). The TIPRA legislation repealed

the exclusion from federal income taxation of a portion of the income generated from certain leveraged leases of aircraft by foreign

sales corporations. See Note 2 to the Consolidated Financial Statements for further discussion of the discontinued operations.