Pitney Bowes 2008 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

In 2008 we took actions to increase our operating effi ciency, optimize our cost

structure and enhance our liquidity.

These actions helped us increase full-year revenue and earnings despite

an increasingly volatile economic environment.

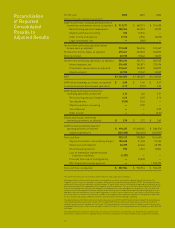

Our annual revenue grew to $6.3 billion, a 2 percent increase, on both

a constant currency and a reported basis. In 2008 adjusted earnings per

share grew 2 percent to $2.78 per diluted share. Both revenue and adjusted

earnings per share were in line with our most recent 2008 guidance. Our

earnings per share from continuing operations on a GAAP basis was $2.13,

which was 31 percent better than the prior year, primarily as a result of

lower charges related to our transition initiatives.

Our 2008 performance is even more notable when the year’s signifi cant

swings in currency are factored in. The dramatic strengthening of the U.S.

dollar, primarily against the euro, the British pound and the Canadian dollar,

had a 5-cent-per-share negative impact on our results for the year, when

compared with our guidance at the start of the year. Excluding this impact,

our adjusted earnings per share for the year would have been $2.83, within

our original guidance range of $2.80 to $2.90.

We generated robust free cash fl ow of $888 million for the year as a result

of our ongoing focus on the balance sheet and cash management.

We continue to maintain a short-term A-1/P-1 rating as a commercial

paper issuer and have taken the following actions to ensure that we preserve

our liquidity and fi nancial fl exibility:

•We have instituted more stringent risk-adjusted rate-of-return

requirements for new acquisitions.

•We have eliminated 2009 salary increases for many of our salaried employees.

•We have chosen not to repurchase shares.

With respect to the capital markets:

•We have only $150 million in bonds maturing in 2009, and no term debt

maturing in 2010 or 2011.

•We have an undrawn $1.5 billion credit facility.

•Our debt and our credit facilities have no fi nancial covenants or material

adverse change clauses, and our credit facility does not mature until

2011, with all original bank commitments intact.

•We are currently eligible for the government’s commercial paper funding

facility program through the Federal Reserve.

We had strong performances in our portfolio despite the challenging

environment. Mail services achieved continued strong revenue and profi t

growth. Cost management initiatives resulted in higher profi t margins in the

production mail, U.S. management services, international mailing and

marketing services businesses. Although annual results were lower in U.S.

mailing, we saw good equipment sales growth in the fourth quarter as more

leases became available for renewal.

At the end of 2007 we announced our transition initiatives restructuring

program in response to changes we were seeing in the environment and in order

to enhance our long-term positioning for growth. During 2008 we took an addi-

tional $200 million of pretax charges to improve our operating effi ciency and

reduce our cost structure to address the changing global economic environment.

A signifi cant portion of the cost savings generated by our transition

initiatives in 2008 was reinvested during the year, including an 11 percent

Financial Highlights

from Our CFO

Michael Monahan

Executive Vice President and

Chief Financial Offi cer