Pitney Bowes 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

53

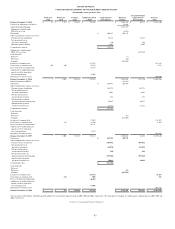

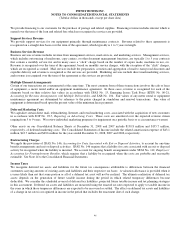

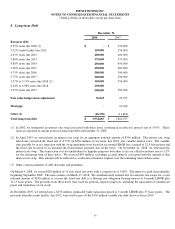

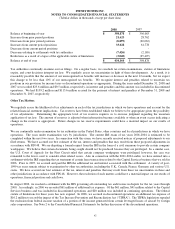

The following table summarizes selected financial data for the opening balance sheet allocations of the acquisitions in 2008 and 2007:

2008 2007

Zipsort, Inc. Asterion SAS Digital Cement, Inc. MapInfo Corporation

Purchase price allocation

Short-term investments $ - $ - $ - $ 46,308

Current assets 42 52,309 2,146 40,121

Other non-current assets 12,617 31,303 932 35,826

Intangible assets 7,942 8,285 6,600 113,000

Goodwill 24,962 25,555 42,583 327,219

Current liabilities (4,063) (58,286) (213) (63,012)

Debt - - - (13,866)

Non-current liabilities (2,994) (30,345) - (50,060)

Purchase price, net of cash acquired $ 38,506 $ 28,821 $ 52,048 $ 435,536

Intangible assets

Customer relationships $ 7,658 $ 6,766 $ 6,100 $ 75,900

Mailing software and technology - - - 29,500

Trademarks and trade names - 1,519 500 7,600

Non-compete agreements 284 - - -

Total intangible assets $ 7,942 $ 8,285 $ 6,600 $ 113,000

Intangible assets amortization period

Customer relationships 15 years 7 years 7 years 10 years

Mailing software and technology - - - 5 years

Trademarks and trade names - 2 years 2 years 5 years

Non-compete agreements 3 years - - -

Total weighted average 15 years 6 years 7 years 8 years

Allocation of the purchase price to the assets acquired and liabilities assumed has not been finalized for Zipsort, Inc. The purchase

price allocation for this acquisition will be finalized upon the completion of working capital closing adjustments and fair value

analysis. Final determination of the purchase price and fair values to be assigned may result in adjustments to the preliminary

estimated values assigned at the date of acquisition. The amount of tax deductible goodwill added from acquisitions in 2008 and 2007

was $27.4 million and $27.5 million, respectively.

During 2008 and 2007, we also completed several smaller acquisitions, the cost of which was $29.7 million and $86.6 million,

respectively. These acquisitions did not have a material impact on our financial results.

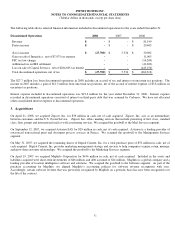

Consolidated impact of acquisitions

The Consolidated Financial Statements include the results of operations of the acquired businesses from their respective dates of

acquisition.

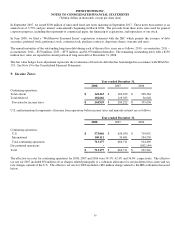

The following table provides unaudited pro forma consolidated revenue for the years ended December 31, 2008 and 2007 as if our

acquisitions had been acquired on January 1 of each year presented:

2008 2007

Total revenue $ 6,288,242 $ 6,351,981