Pitney Bowes 2008 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

82

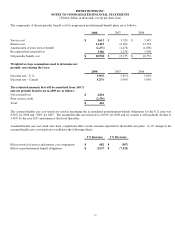

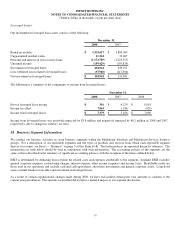

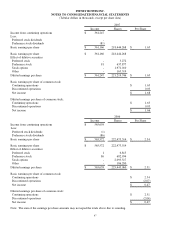

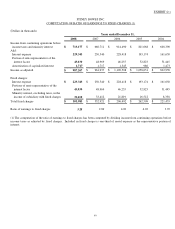

Reconciliation of Segment Amounts to Consolidated Totals:

Years ended December 31,

2008 2007 2006

EBIT:

Total EBIT for reportable segments $ 1,345,136 $ 1,379,715 $ 1,368,162

Unallocated amounts:

Interest, net (216,450) (241,871) (212,596)

Corporate expense (209,543) (210,544) (208,099)

Restructuring charges and asset impairments (200,254) (264,013) (35,999)

Other items (5,712) (2,576) 3,022

Income from continuing operations

before income taxes and minority interest $ 713,177 $ 660,711 $ 914,490

Depreciation and amortization:

Total depreciation and amortization for reportable

segments $ 360,231 $ 368,431 $ 336,064

Corporate depreciation 18,886 14,710 15,216

Discontinued operations - - 11,978

Consolidated depreciation and amortization $ 379,117 $ 383,141 $ 363,258

Capital expenditures:

Total additions for reportable segments $ 222,614 $ 242,133 $ 306,832

Unallocated amounts 14,694 22,523 21,045

Consolidated capital expenditures $ 237,308 $ 264,656 $ 327,877

December 31,

2008 2007

Total assets:

Total identifiable assets by reportable segments $ 7,953,613 $ 8,694,262

Cash and cash equivalents and short-term investments 398,222 440,455

General corporate assets 384,596 331,014

Consolidated assets $ 8,736,431 $ 9,465,731

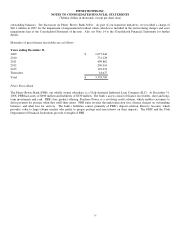

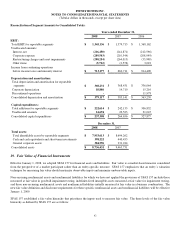

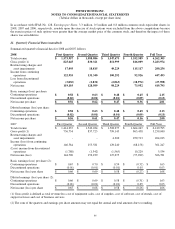

19. Fair Value of Financial Instruments

Effective January 1, 2008, we adopted SFAS 157 for financial assets and liabilities. Fair value is a market-based measure considered

from the perspective of a market participant rather than an entity-specific measure. SFAS 157 emphasizes that an entity’s valuation

technique for measuring fair value should maximize observable inputs and minimize unobservable inputs.

Non-recurring nonfinancial assets and nonfinancial liabilities for which we have not applied the provisions of SFAS 157 include those

measured at fair value in goodwill impairment testing, indefinite-lived intangible assets measured at fair value for impairment testing,

and those non-recurring nonfinancial assets and nonfinancial liabilities initially measured at fair value in a business combination. The

new fair value definition and disclosure requirements for these specific nonfinancial assets and nonfinancial liabilities will be effective

January 1, 2009.

SFAS 157 established a fair value hierarchy that prioritizes the inputs used to measure fair value. The three levels of the fair value

hierarchy as defined by SFAS 157 are as follows: