Pitney Bowes 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

77

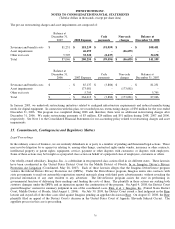

We expect to prevail in the lawsuits against Imagitas; however, as litigation is inherently unpredictable, there can be no assurance in

this regard. If the plaintiffs do prevail, the results may have a material effect on our financial position, future results of operations or

cash flows, including, for example, our ability to offer certain types of goods or services in the future.

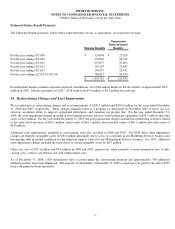

Product Warranty

We provide product warranties in conjunction with certain product sales, generally for a period of 90 days from the date of

installation. Our product warranty liability reflects our best estimate of probable liability or product warranties based on historical

claims experience, which has not been significant, and other currently available evidence. Accordingly, our product warranty liability

at December 31, 2008 and 2007, respectively, was not material.

16. Leases

In addition to factory and office facilities owned, we lease similar properties, as well as sales and service offices, equipment and

other properties, generally under long-term operating lease agreements extending from 3 to 25 years.

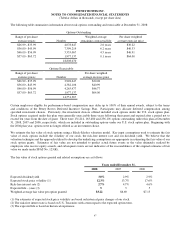

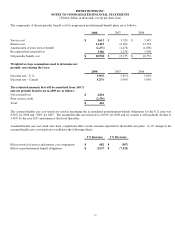

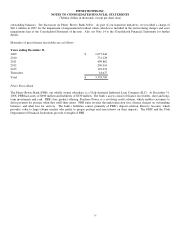

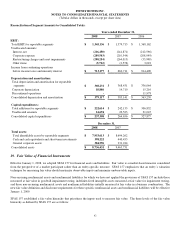

Future minimum lease payments under non-cancelable operating leases at December 31, 2008 are as follows:

Years ending December 31, Operating leases

2009 $ 80,622

2010 61,696

2011 45,468

2012 32,956

2013 21,163

Thereafter 25,338

Total minimum lease payments $ 267,243

Rental expense was $129.1 million, $146.9 million and $138.8 million in 2008, 2007 and 2006, respectively.

17. Finance Assets

Finance Receivables

Finance receivables are generally due in monthly, quarterly or semi-annual installments over periods ranging from 3 to 5 years and are

comprised of sales-type leases and customer loan receivables.

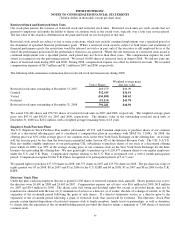

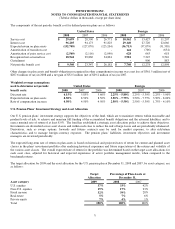

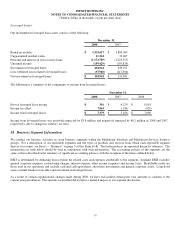

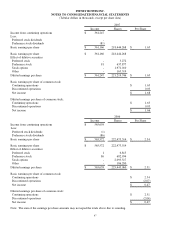

The components of finance receivables were as follows:

December 31,

2008 2007

Gross finance receivables $ 3,338,799 $ 3,587,947

Unguaranteed residual values 273,529 260,815

Unearned income (666,742) (740,046)

Initial direct cost deferred 1,914 1,914

Allowance for credit losses (71,790) (78,371)

Net investment in finance receivables $ 2,875,710 $ 3,032,259

Net investment in finance receivables include net customer loan receivables at December 31, 2008 and 2007 of $528.8 million and

$552.9 million, respectively. Customer loan receivables arise primarily from financing services offered to our customers for postage,

supplies, and shipping payments. Customer loan receivables are generally due each month, however, customers may rollover