Pep Boys 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

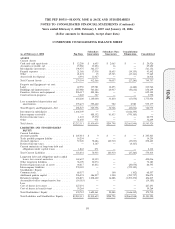

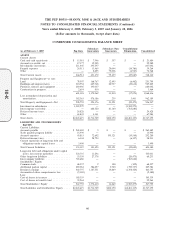

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2008, February 3, 2007 and January 28, 2006

(dollar amounts in thousands, except share data)

holders of the convertible notes to convert them into shares of the Company’s common stock, at any

time until the June 1, 2007 maturity date, survived such satisfaction and discharge, although no notes

were converted prior to maturity. The Company recorded a non-cash charge for the value of such

conversion right, approximately $755 as determined by the Black-Scholes method, and $430 for

deferred financing cost.

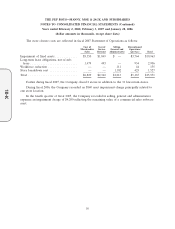

On February 15, 2007, the Company further amended the Senior Secured Term Loan facility to

reduce the interest rate from LIBOR plus 2.75% to LIBOR plus 2.00%.

On November 27, 2007, the Company sold the land and buildings for 34 owned properties to an

independent third party. Concurrent with the sale, the Company entered into agreements to lease the

stores back from the purchaser over minimum lease terms of 15 years. The Company used $162,558 of

the net proceeds to prepay a portion of the Senior Secured Term Loan facility. This prepayment in

conjunction with the ordinary amortization of the principal balance, reduced the principal amount of

the facility to $155,000 and reduced the scheduled quarterly repayments from $800 to $391. The

number of stores in the collateral pool, which secures the facility, was simultaneously reduced by 136

stores (bringing the total remaining collateral to 105). The Company has continuing involvement in one

property and has recorded the $4,742 proceeds, net of execution costs, as a debt borrowing and

continues to reflect the property on its balance sheet in accordance with Statement of Financial

Accounting Standards No. 13, ‘‘Accounting for Leases.’’

Senior Subordinated Notes due December, 2014

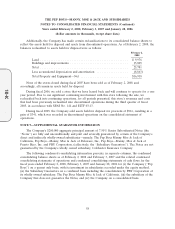

On December 14, 2004, the Company issued $200,000 aggregate principal amount of 7.5% Senior

Subordinated Notes due December 15, 2014.

Line of Credit Agreement due December, 2009

On December 2, 2004, the Company further amended its amended and restated line of credit

agreement. The amendment increased the amount available for borrowings to $357,500, with an ability,

upon satisfaction of certain conditions, to increase such amount to $400,000. The amendment also

reduced the interest rate under the agreement to LIBOR plus 1.75% (after June 1, 2005, the rate

decreased to LIBOR plus 1.50%, subject to 0.25% incremental increases as excess availability falls

below $50,000). The amendment also provided the flexibility, upon satisfaction of certain conditions, to

release up to $99,000 of reserved credit line availability required as of December 2, 2004 under the line

of credit agreement to support certain operating leases. This reserve was $73,924 on February 2, 2008.

Finally, the amendment extended the term of the agreement through December 2009. The weighted

average interest rate on borrowings under the line of credit agreement was 7.51% and 7.67% at

February 2, 2008 and February 3, 2007, respectively.

50

10-K