Pep Boys 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

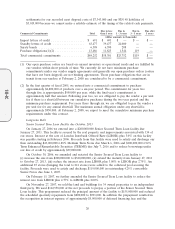

settlements for our recorded asset disposal costs of $7,343,000 and our FIN 48 liabilities of

$5,019,000 because we cannot make a reliable estimate of the timing of the related cash payments.

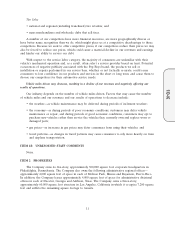

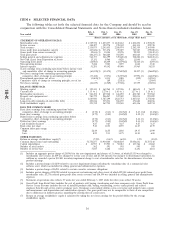

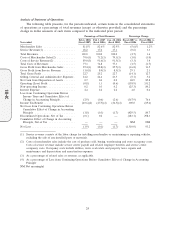

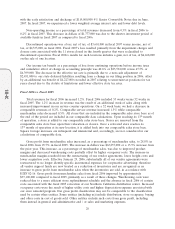

Due in less Due in Due in Due after

Commercial Commitments Total than 1 year 1 - 3 years 3 - 5 years 5 years

(dollar amounts in thousands)

Import letters of credit ................... $ 691 $ 691 $ — $ — $ —

Standby letters of credit .................. 63,477 39,477 24,000 — —

Surety bonds .......................... 6,598 6,390 208 — —

Purchase obligations(1)(2) ................. 13,486 11,823 1,544 119 —

Total commercial commitments ............. $84,252 $58,381 $25,752 $119 $ —

(1) Our open purchase orders are based on current inventory or operational needs and are fulfilled by

our vendors within short periods of time. We currently do not have minimum purchase

commitments under our vendor supply agreements and generally our open purchase orders (orders

that have not been shipped) are not binding agreements. Those purchase obligations that are in

transit from our vendors at February 2, 2008 are considered to be a commercial commitment.

(2) In the first quarter of fiscal 2005, we entered into a commercial commitment to purchase

approximately $4,800,000 of products over a six-year period. The commitment for years two

through five is approximately $950,000 per year, while the final year’s commitment is

approximately half that amount. Following year two, we are obligated to pay the vendor a per unit

fee if there is a shortfall between our cumulative purchases during the two year period and the

minimum purchase requirement. For years three through six, we are obligated to pay the vendor a

per unit fee for any annual shortfall. The maximum annual obligation under any shortfall is

approximately $950,000. At February 2, 2008, we expect to meet the cumulative minimum purchase

requirements under this contract.

Long-term Debt

Senior Secured Term Loan Facility due October, 2013

On January 27, 2006 we entered into a $200,000,000 Senior Secured Term Loan facility due

January 27, 2011. This facility is secured by the real property and improvements associated with 154 of

our stores. Interest at the rate of London Interbank Offered Rate (LIBOR) plus 3.0% on this facility

was payable starting in February 2006. Proceeds from this facility were used to satisfy and discharge our

then outstanding $43,000,000 6.88% Medium Term Notes due March 6, 2006 and $100,000,000 6.92%

Term Enhanced Remarketable Securities (TERMS) due July 7, 2016 and to reduce borrowings under

our line of credit by approximately $39,000,000.

On October 30, 2006, we amended and restated the Senior Secured Term Loan facility to

(i) increase the size from $200,000,000 to $320,000,000, (ii) extend the maturity from January 27, 2011

to October 27, 2013, (iii) reduce the interest rate from LIBOR plus 3.00% to LIBOR plus 2.75%. An

additional 87 stores (bringing the total to 241 stores) were added to the collateral pool securing the

facility. Proceeds were used to satisfy and discharge $119,000,000 in outstanding 4.25% convertible

Senior Notes due June 1, 2007.

On February 15, 2007, we further amended the Senior Secured Term Loan facility to reduce the

interest rate from LIBOR plus 2.75% to LIBOR plus 2.00%.

On November 27, 2007, we sold the land and buildings for 34 owned properties to an independent

third party. We used $162,558,000 of the net proceeds to prepay a portion of the Senior Secured Term

Loan facility. This prepayment reduced the principal amount of the facility to $155,000,000 and reduced

the scheduled quarterly repayments from $800,000 to $391,000. In addition the prepayment resulted in

the recognition in interest expense of approximately $5,900,000 of deferred financing fees and the

20

10-K