Pep Boys 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In December 2007, the FASB issued SFAS No. 160, ‘‘Noncontrolling Interests in Consolidated

Financial Statements—an amendment of ARB No. 51.’’ SFAS No. 160, among other things, provides

guidance and establishes amended accounting and reporting standards for a parent company’s

noncontrolling interest in a subsidiary. SFAS No. 160 is effective for fiscal years beginning on or after

December 15, 2008. We do not expect the adoption of SFAS No. 160 to have a material impact on our

financial condition, results of operations or cash flows.

In March 2008, the FASB issued SFAS No. 161, ‘‘Disclosures about Derivative Instruments and

Hedging Activities.’’ SFAS No. 161 expands the disclosure requirements in SFAS No. 133, ‘‘Accounting

for Derivative Instruments and Hedging Activities,’’ about an entity’s derivative instruments and

hedging activities. SFAS No. 161 is effective for financial statements issued for fiscal years and interim

periods beginning after November 15, 2008. We are currently evaluating the impact SFAS No. 161 will

have on our consolidated financial statements.

ITEM 7A QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Company has market rate exposure in its financial instruments primarily due to changes in

interest rates.

Variable Rate Debt

Pursuant to terms of its revolving credit agreement, changes in LIBOR could affect the rates of

which the Company could borrow funds there under. At February 2, 2008, the Company had

outstanding borrowings of $42,045,000 against the revolving credit agreement. Additionally, the

Company has a Senior Secured Term Loan facility with a balance of $154,652,000 at February 2, 2008,

that bears interest at three month LIBOR plus 2.00%, and $116,318,000 of real estate operating leases

and $9,836,000 of equipment operating leases which have lease payments that vary based on changes in

LIBOR. A one percent change in the LIBOR rate would have affected net loss by approximately

$1,918,000 for the fiscal year ended February 2, 2008.

Fixed Rate Debt

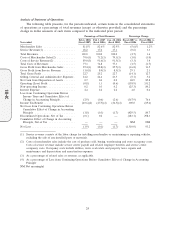

The table below summarizes the fair value and contract terms of fixed rate debt instruments held

by the Company at February 2, 2008:

Average

(dollar amounts in thousands) Amount Interest Rate

Fair value at February 2, 2008 ....................... $199,137

Expected maturities:

2008 ......................................... $ 486 6.03%

2009 ......................................... 247 3.74

2010 ......................................... 258 3.74

2011 ......................................... 270 3.74

2012 ......................................... 281 3.74

Thereafter ..................................... 203,493 7.43%

Total Carrying Amount ............................ $205,035

At February 3, 2007, the Company had outstanding $200,268,000 of fixed rate notes with an

aggregate fair market value of $189,268,000.

The Company determines fair value on its fixed rate debt by using quoted market prices and

current interest rates.

32

10-K