Pep Boys 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

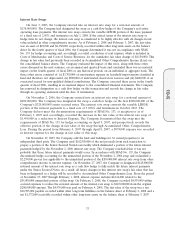

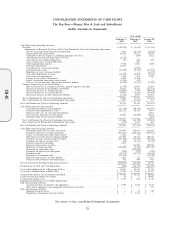

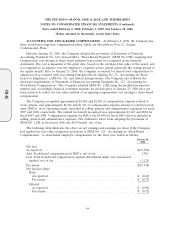

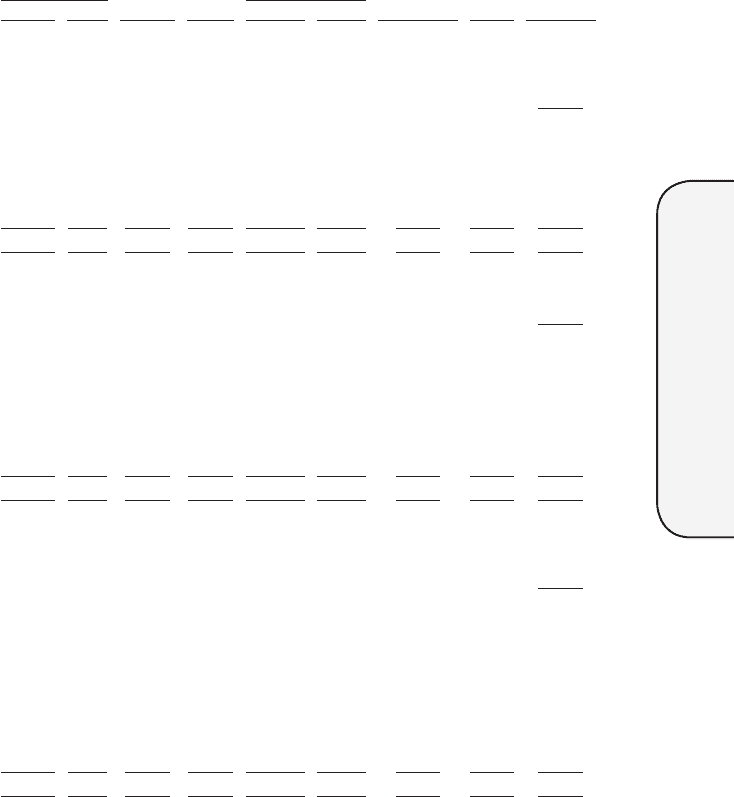

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

The Pep Boys—Manny, Moe & Jack and Subsidiaries

(dollar amounts in thousands, except share data)

Accumulated

Additional Other Total

Common Stock Treasury Stock

Paid-in Retained Comprehensive Benefit Stockholders’

Shares Amount Capital Earnings Shares Amount Loss Trust Equity

Balance, January 29, 2005 . . . . . . ........... 68,557,041 $68,557 $284,966 $536,780 (11,305,130) $(172,731) $ (4,852) $(59,264) $653,456

Comprehensive Loss:

Net loss . . . . . . .................... (37,528) (37,528)

Minimum pension liability adjustment, net of tax . .... (22) (22)

Fair market value adjustment on derivatives, net of tax . . 1,309 1,309

Total Comprehensive Loss . . . . . . ........... (36,241)

Cash dividends ($.27 per share) . . . ........... (14,686) (14,686)

Effect of stock options and related tax benefits . . . . . . 1,719 (2,520) 338,856 5,592 4,791

Effect of restricted stock unit conversions . . . . . . . . . (636) 28,981 433 (203)

Stock compensation expense ............... 2,049 2,049

Repurchase of Common Stock . . . ........... (1,282,600) (15,562) (15,562)

Dividend reinvestment plan ................ (120) 66,925 1,081 961

Balance, January 28, 2006 . . . . . . ........... 68,557,041 68,557 288,098 481,926 (12,152,968) (181,187) (3,565) (59,264) 594,565

Comprehensive Loss:

Net loss . . . . . . .................... (2,549) (2,549)

Minimum pension liability adjustment, net of tax . .... 887 887

Fair market value adjustment on derivatives, net of tax . . (3,648) (3,648)

Total Comprehensive Loss . . . . . . ........... (5,310)

Cash dividends ($.27 per share) . . . ........... (14,757) (14,757)

Incremental effect from adoption of FAS No. 158, net of

tax............................ (3,054) (3,054)

Effect of stock options and related tax benefits . . . . . . (669) (657) 80,641 1,387 61

Effect of restricted stock unit conversions . . . . . . . . . (1,096) 74,107 712 (384)

Stock compensation expense ............... 3,051 3,051

Repurchase of Common Stock . . . ........... (494,800) (7,311) (7,311)

Dividend reinvestment plan ................ (166) 65,333 1,060 894

Balance, February 3, 2007 . . . . . . ........... 68,557,041 68,557 289,384 463,797 (12,427,687) (185,339) (9,380) (59,264) 567,755

Comprehensive Loss:

Net loss . . . . . . .................... (41,039) (41,039)

Changes in net unrecognized other postretirement benefit

costs, net of tax . . . .................. 2,462 2,462

Fair market value adjustment on derivatives, net of tax . . (7,388) (7,388)

Total Comprehensive Loss . . . . . . ........... (45,965)

Cash dividends ($.27 per share) . . . ........... (14,177) (14,177)

Incremental effect from adoption of FIN No. 48, net of

tax............................ (155) (155)

FAS No. 158 change in measurement date effect, net of

tax............................ (189) 123 (66)

Effect of stock options and related tax benefits . . . . . . 1,752 (1,332) 291,125 4,984 5,404

Effect of restricted stock unit conversions . . . . . . . . . (4,818) 176,256 3,038 (1,780)

Stock compensation expense ............... 9,756 9,756

Repurchase of Common Stock . . . ........... (2,702,460) (50,841) (50,841)

Dividend reinvestment plan ................ (86) 53,672 867 781

Balance, February 2, 2008 . . . . . . ........... 68,557,041 $68,557 $296,074 $406,819 (14,609,094) $(227,291) $(14,183) $(59,264) $470,712

See notes to the consolidated financial statements

37

10-K