Pep Boys 2007 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2008, February 3, 2007 and January 28, 2006

(dollar amounts in thousands, except share data)

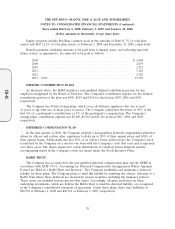

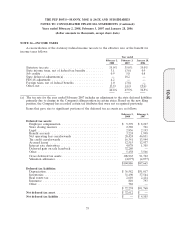

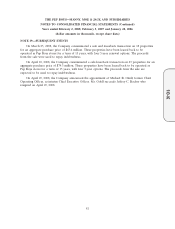

2006 or any historical periods, on an individual or aggregate basis. The three other errors consisted of:

(i) $3,700 of amortization expense on leasehold improvements classified in land and therefore not

depreciated, (ii) $500 of understated closed store reserves and (iii) $400 of an overstated accrual for

non-qualified defined contributions. The Company corrected these errors in the fourth quarter of fiscal

2006, resulting in no material impact to the consolidated financial statements. The Company has

removed its designation as a cash flow hedge on this transaction and records the change in fair value

through its operating statement until the date of termination.

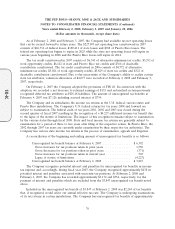

On November 2, 2006, the Company entered into an interest rate swap for a notional amount of

$200,000. The Company has designated the swap a cash flow hedge on the first $200,000 of the

Company’s $320,000 senior secured notes. The interest rate swap converts the variable LIBOR portion

of the interest payments to a fixed rate of 5.036% and terminates in October 2013. The Company did

not meet the documentation requirements of SFAS No. 133, at inception or as of February 3, 2007 and,

accordingly, recorded the increase in the fair value of the interest rate swap of $1,490 as a reduction to

Interest Expense during fiscal 2006. The Company documented that the swap met the requirements of

SFAS No. 133 for hedge accounting on April 9, 2007 and prospectively records the effective portion of

the change in fair value through Accumulated Other Comprehensive Loss. During the period from

February 4, 2007 through April 8, 2007, a $974 expense was recorded in interest expense for the change

in fair value of this swap.

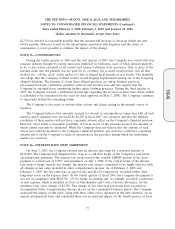

On November 27, 2007, the Company sold the land and buildings for 34 owned properties to an

independent third party. The Company used $162,558 of the net proceeds from such transaction to

prepay a portion of the Senior Secured Term Loan facility which eliminated a portion of the future

interest payments hedged by the November 2, 2006 interest rate swap. The Company concluded that it

was not probable that those future interest payments would occur. In accordance with SFAS No. 133,

the Company discontinued hedge accounting for the unmatched portion of the November 2, 2006 swap

and reclassified a $2,259 pre-tax loss applicable to the unmatched portion of the $200,000 interest rate

swap from other comprehensive income to interest expense. On November 27, 2007, the Company

re-designated $145,000 notional amount of the $200,000 interest rate swap as a cash flow hedge to fully

match the future interest payments under the Senior Secured Notes. As a result, all future changes in

this interest rate swap’s fair value that has been re-designated as a hedge will be recorded to

Accumulated Other Comprehensive Loss. From the period of November 27, 2007 through February 1,

2008, the Company incurred interest expense of $1,907 for changes in fair value related to the $55,000

unmatched portion of this swap. On February 1, 2008, the Company recorded $4,539 within accrued

expenses to reduce the notional amount of the interest rate swap to $145,000 from the original

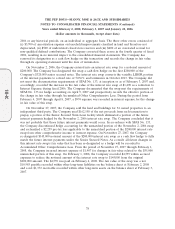

$200,000 amount. The $4,539 was paid on February 4, 2008. The fair value of the swap was a net

$10,985 payable recorded within other long-term liabilities on the balance sheet at February 2, 2008

and a net $1,372 receivable recorded within other long-term assets on the balance sheet at February 3,

2007.

78

10-K