Pep Boys 2007 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

How are candidates identified and evaluated?

Identification. The Nominating and Governance Committee considers all candidates recommended by our

shareholders, directors and senior management on an equal basis. The Nominating and Governance Committee’s

preference is to identify nominees using our own resources, but has the authority to and will engage search firms(s)

as necessary.

Qualifications. The Nominating and Governance Committee evaluates each candidate’s judgment, diversity

(age, gender, ethnicity, etc.) and professional background and experience, as well as, his or her independence from

Pep Boys. Such qualifications are evaluated against our then current requirements, as expressed by the Chief

Executive Officer, and the current make up of the full Board.

Evaluations. Candidates are evaluated on the basis of their resume, third party references, public reputation and

personnel interviews. Before a candidate can be recommended to the full Board, such candidate must, at a

minimum, have been interviewed by each member of the Nominating and Governance Committee and have met, in

person, with at least one member of the Nominating and Governance Committee, the Chairman of the Board and the

Chief Executive Officer.

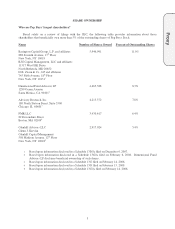

How are directors compensated?

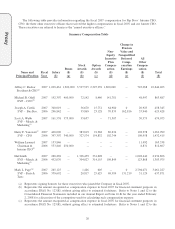

Base Compensation. Each non-management director (other than the Chairman of the Board) receives an annual

director’s fee of $35,000. Our Chairman of the Board receives an annual director’s fee of $80,000.

Committee Compensation. Directors serving on our standing Board committees also receive the following

annual fees.

Chair Member

Audit $25,000 $15,000

Human Resources $10,000 $ 5,000

Nominating and Governance $10,000 $ 5,000

In addition, members of special committees appointed by the Board receive a one-time fee upon appointment to

such committees of $15,000.

A director may elect to have all or a part of his or her director’s fees deferred. Amounts deferred receive a rate

of return equal to the prime interest rate or the performance of Pep Boys Stock (represented by stock units), as

elected by the director, and are paid at a later date chosen by the director at the time of deferral. A director who is

also an employee of Pep Boys receives no additional compensation for service as a director.

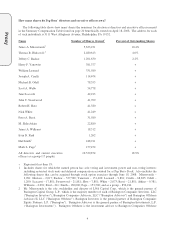

Equity Grants. The Pep Boys 1999 Stock Incentive Plan, or the 1999 Plan, provides for an annual grant of

restricted stock units and options having an aggregate value of $45,000 to non-management directors. Restricted

stock units granted to non-management directors vest in 25% increments over four years commencing on the first

anniversary of the date of grant; provided, however, that the receipt of the shares underlying the restricted stock

units is automatically deferred until termination of service as a director. The stock options granted to non-

management directors are priced at the fair market value of Pep Boys Stock on the date of grant. Twenty percent of

the stock options granted are exercisable immediately and an additional 20% become exercisable on each of the next

four anniversaries of the grant date. The 1999 Plan is administered, interpreted and implemented by the Human

Resources Committee of the Board of Directors.

Proxy