Pep Boys 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2008, February 3, 2007 and January 28, 2006

(dollar amounts in thousands, except share data)

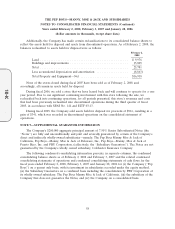

In December 2007, the FASB issued SFAS No. 160, ‘‘Noncontrolling Interests in Consolidated

Financial Statements—an amendment of ARB No. 51.’’ SFAS No. 160, among other things, provides

guidance and establishes amended accounting and reporting standards for a parent company’s

noncontrolling interest in a subsidiary. SFAS No. 160 is effective for fiscal years beginning on or after

December 15, 2008. The Company does not expect the adoption of SFAS No. 160 to have a material

impact on its financial condition, results of operations or cash flows.

In March 2008, the FASB issued SFAS No. 161, ‘‘Disclosures about Derivative Instruments and

Hedging Activities.’’ SFAS No. 161 expands the disclosure requirements in SFAS No. 133, ‘‘Accounting

for Derivative Instruments and Hedging Activities,’’ about an entity’s derivative instruments and

hedging activities. SFAS No. 161 is effective for financial statements issued for fiscal years and interim

periods beginning after November 15, 2008. The Company is currently evaluating the impact SFAS

No. 161 will have on its consolidated financial statements.

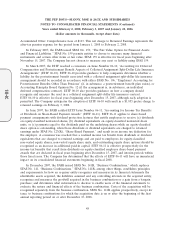

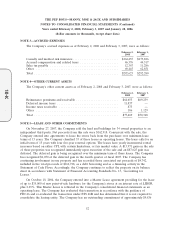

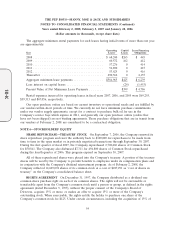

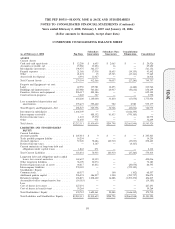

NOTE 2—DEBT AND FINANCING ARRANGEMENTS

LONG-TERM DEBT

February 2, February 3,

2008 2007

7.50% Senior Subordinated Notes, due December 2014 .................. $200,000 $200,000

Senior Secured Term Loan, due October 2013 ......................... 154,652 320,000

Other notes payable, 8.0% ....................................... 248 268

Lease financing obligations, payable through October 2022 ................ 4,786 —

Capital lease obligations payable through October 2009 .................. 399 685

Line of credit agreement, through December 2009 ...................... 42,045 17,568

402,130 538,521

Less current maturities .......................................... 2,114 3,490

Total Long-Term Debt .......................................... $400,016 $535,031

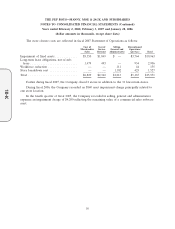

Senior Secured Term Loan due October, 2013

On January 27, 2006 the Company entered into a $200,000 Senior Secured Term Loan facility due

January 27, 2011. This facility was secured by the real property and improvements associated with 154

of the Company’s stores. Interest at the rate of London Interbank Offered Rate (LIBOR) plus 3.0% on

this facility was payable by the Company starting in February 2006. Proceeds from this facility were

used to satisfy and discharge the Company’s then outstanding $43,000 6.88% Medium Term Notes due

March 6, 2006 and $100,000 6.92% Term Enhanced Remarketable Securities (TERMS) due July 7,

2016 and to reduce borrowings under the Company’s line of credit by approximately $39,000.

On October 27, 2006, the Company amended and restated the Senior Secured Term Loan facility

to (i) increase the size from $200,000 to $320,000, (ii) extend the maturity from January 27, 2011 to

October 27, 2013, (iii) reduce the interest rate from LIBOR plus 3.00% to LIBOR plus 2.75%. An

additional 87 stores (bringing the total to 241 stores) were added to the collateral pool securing the

facility. Proceeds were used to satisfy and discharge $119,000 in outstanding 4.25% convertible Senior

Notes due June 1, 2007 by deposit into an escrow fund with an independent trustee. The right of the

49

10-K