Pep Boys 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2008, February 3, 2007 and January 28, 2006

(dollar amounts in thousands, except share data)

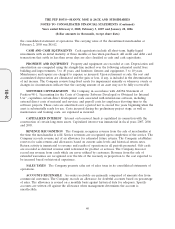

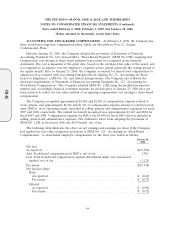

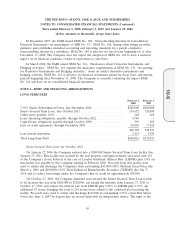

aggregates all of its stores and reports one operating and reporting segment. Sales by major product

categories are as follows:

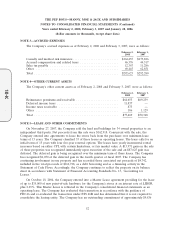

Feb. 2, Feb. 3, Jan. 28,

Year ended 2008 2007 2006

Parts and Accessories ......................... $1,423,891 $1,537,076 $1,531,409

Tires ..................................... 325,687 316,001 299,222

Total Merchandise Sales ....................... 1,749,578 1,853,077 1,830,631

Service Labor ............................... 388,497 390,778 378,343

Total Revenues .............................. $2,138,075 $2,243,855 $2,208,974

SIGNIFICANT SUPPLIERS During fiscal 2007, the Company’s ten largest suppliers accounted

for approximately 43% of the merchandise purchased by the Company. No single supplier accounted

for more than 19% of the Company’s purchases. The Company has no long-term contracts under which

the Company is required to purchase merchandise except for a contract to purchase bulk oil for use in

the Company’s service bays, which expires in 2011. Management believes that the relationships the

Company has established with its suppliers are generally good.

SELF INSURANCE The Company has risk participation arrangements with respect to workers’

compensation, general liability, automobile liability, and other casualty coverages. The Company has a

wholly owned captive insurance subsidiary through which it reinsures this retained exposure. This

subsidiary uses both risk sharing pools and third party insurance to manage this exposure. In addition,

the Company self insures certain employee-related health care benefit liabilities. The Company

maintains stop loss coverage with third party insurers through which it reinsures certain of its casualty

and health care benefit liabilities. The Company records both liabilities and reinsurance receivables

using actuarial methods utilized in the insurance industry based upon our historical claims experience.

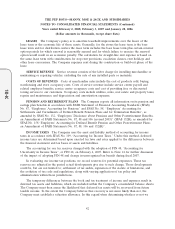

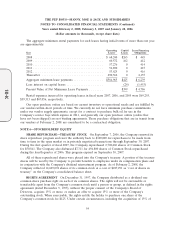

RECENT ACCOUNTING STANDARDS

In February 2006, the FASB issued SFAS No. 155, ‘‘Accounting for Certain Hybrid Financial

Instruments—an amendment of FASB Statements No. 133 and 140’’ (SFAS No. 155). SFAS No. 155

simplifies accounting for certain hybrid instruments currently governed by SFAS No. 133, ‘‘Accounting

for Derivative Instruments and Hedging Activities,’’ or SFAS No. 133, by allowing fair value

remeasurement of hybrid instruments that contain an embedded derivative that otherwise would

require bifurcation. SFAS No. 155 is effective for all financial instruments acquired or issued in fiscal

years beginning after September 15, 2006. The Company adopted this standard on February 4, 2007,

which did not affect our consolidated financial statements.

In March 2006, the FASB issued SFAS No. 156, ‘‘Accounting for Servicing of Financial Assets—an

amendment of FASB Statement No. 140’’ (SFAS No. 156). SFAS No. 156 amends SFAS No. 140,

‘‘Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities,’’ with

respect to the accounting for separately recognized servicing assets and servicing liabilities. SFAS

No. 156 was effective for fiscal years beginning after September 15, 2006. The Company adopted this

standard on February 4, 2007, which did not affect our consolidated financial statements.

46

10-K