Pep Boys 2007 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

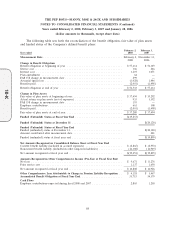

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2008, February 3, 2007 and January 28, 2006

(dollar amounts in thousands, except share data)

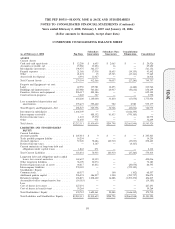

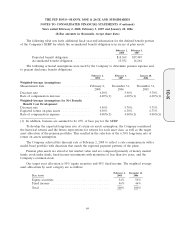

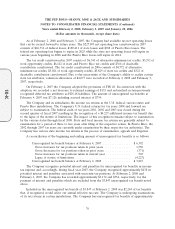

The following table sets forth the reconciliation of the benefit obligation, fair value of plan assets

and funded status of the Company’s defined benefit plans:

February 2, February 3,

Year ended 2008 2007

Measurement Date ............................................... February 2, December 31,

2008 2006

Change in Benefit Obligation:

Benefit obligation at beginning of year ................................. $57,614 $ 54,349

Service cost .................................................... 166 246

Interest cost ................................................... 3,419 3,071

Plan amendment ................................................ 64 —

FAS 158 change in measurement date .................................. 299 —

Actuarial (gain) loss .............................................. (3,028) 1,446

Benefits paid ................................................... (2,001) (1,498)

Benefit obligation at end of year ..................................... $56,533 $ 57,614

Change in Plan Assets:

Fair value of plan assets at beginning of year ............................. $37,494 $ 35,292

Actual return on plan assets (net of expenses) ............................ 933 3,392

FAS 158 change in measurement date .................................. 193 —

Employer contributions ............................................ 661 308

Benefits paid ................................................... (2,001) (1,498)

Fair value of plan assets at end of year ................................. $37,280 $ 37,494

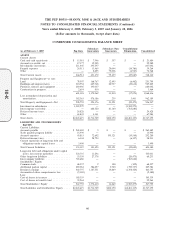

Funded (Unfunded) Status at Fiscal Year End ............................ $(19,253)

Funded (Unfunded) Status at December 31 .............................. $(20,120)

Funded (Unfunded) Status at Fiscal Year End

Funded (unfunded) status at December 31 ............................... $(20,120)

Amount contributed after measurement date ............................. 221

Funded (unfunded) status at fiscal year end .............................. $(19,899)

Net Amounts Recognized on Consolidated Balance Sheet at Fiscal Year End

Current benefit liability (included in accrued expenses) ...................... $ (2,865) $ (2,950)

Noncurrent benefit liability (included in other long-term liabilities) .............. (16,388) (16,949)

Net amount recognized at fiscal year end ................................ $(19,253) $(19,899)

Amounts Recognized in Other Comprehensive Income (Pre-Tax) at Fiscal Year End

Net loss ...................................................... $ 9,671 $ 13,276

Prior service cost ................................................ 1,137 1,650

Net amount recognized at fiscal year end ................................ $10,808 $ 14,926

Other Comprehensive Loss Attributable to Change in Pension Liability Recognition . . $ 4,118 $ 3,467

Accumulated Benefit Obligation at Fiscal Year End ......................... 53,715 54,379

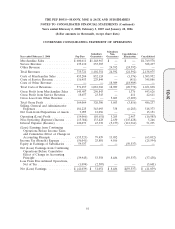

Cash Flows

Employer contributions expected during fiscal 2008 and 2007 .................. 2,865 1,258

68

10-K