Pep Boys 2007 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2008, February 3, 2007 and January 28, 2006

(dollar amounts in thousands, except share data)

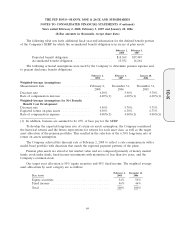

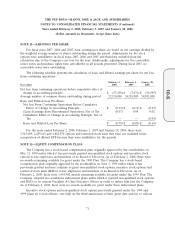

As of February 2, 2008 and February 3, 2007, the Company had available tax net operating losses

that can be carried forward to future years. The $227,895 net operating loss carryforward in 2007

consists of $46,716 of federal losses; $180,411 of state losses and $768 of Puerto Rico losses. The

federal net operating loss begins to expire in 2025 while the state net operating losses will expire in

various years beginning in 2008 and the Puerto Rico losses will expire in 2014.

The tax credit carryforward in 2007 consists of $6,541 of alternative minimum tax credits, $3,292 of

work opportunity credits, $6,142 of state and Puerto Rico tax credits and $366 of charitable

contribution carryforward. The tax credit carryforward in 2006 consists of $4,772 of alternative

minimum tax credits, $3,021 of work opportunity credits, $5,829 of state tax credits and $322 of

charitable contribution carryforward. Due to the uncertainty of the Company’s ability to realize certain

state tax attributes, valuation allowances of $4,077 were recorded at February 2, 2008 and February 3,

2007, respectively.

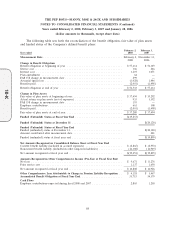

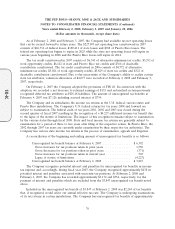

On February 4, 2007 the Company adopted the provisions of FIN 48. In connection with the

adoption, we recorded a net decrease to retained earnings of $155 and reclassified certain previously

recognized deferred tax attributes as FIN 48 liabilities. The amount of unrecognized tax benefits at

February 4, 2007 was $7,126 including accrued interest of $734.

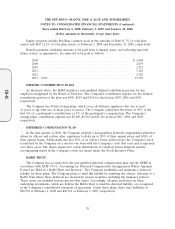

The Company and its subsidiaries file income tax returns in the U.S. federal, various states and

Puerto Rico jurisdictions. The Company’s U.S. federal returns for tax years 2004 and forward are

subject to examination. The federal audit of tax years 2001, 2002 and 2003 was closed during the

second quarter of fiscal 2007 resulting in the recognition of a $4,227 additional income tax benefit due

to the lapse of the statute of limitations. The impact of this recognition remains subject to examination

by the various states through fiscal 2008. State and local income tax returns are generally subject to

examination for a period of three to five years after filing of the respective return. In Puerto Rico, the

2002 through 2007 tax years are currently under examination by their respective tax authorities. The

Company has various state income tax returns in the process of examination, appeals and litigation.

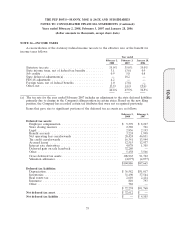

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

Unrecognized tax benefit balance at February 4, 2007 ................ $6,392

Gross increases for tax positions taken in prior years ............... 1,550

Gross decreases for tax positions taken in prior years ............... (371)

Gross increases for tax positions taken in current year .............. 503

Lapse of statute of limitations ................................ (4,227)

Unrecognized tax benefit balance at February 2, 2008 ................ $3,847

The Company recognizes potential interest and penalties for unrecognized tax benefits in income

tax expense and, accordingly, during fiscal year 2007, the Company recognized approximately $438 in

potential interest and penalties associated with uncertain tax positions. At February 2, 2008 and

February 4, 2007, the Company has recorded approximately $1,172 and $734, respectively, for the

payment of interest and penalties which are excluded from the $3,847 unrecognized tax benefit noted

above.

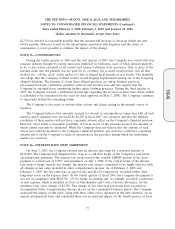

Included in the unrecognized tax benefit of $3,847 at February 2, 2008 was $2,244 of tax benefits

that, if recognized, would affect our annual effective tax rate. The Company is undergoing examinations

of its tax returns in certain jurisdictions. The Company has unrecognized tax benefits of approximately

76

10-K