Pep Boys 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11APR200819445712

In March of 2007, the Company adopted two standalone inducement plans under which it granted

non-qualified stock options and RSUs to its then current President & Chief Executive Officer in order

to induce him to join the Company. As of February 2, 2008, there were no awards available for grant

under these inducement plans.

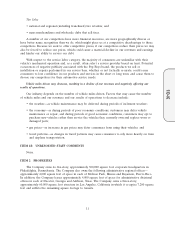

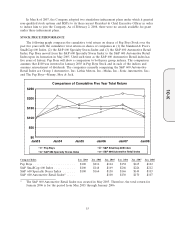

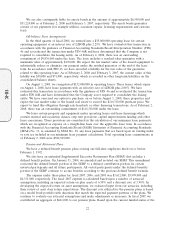

STOCK PRICE PERFORMANCE

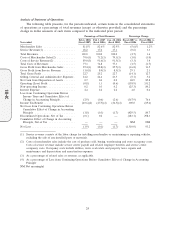

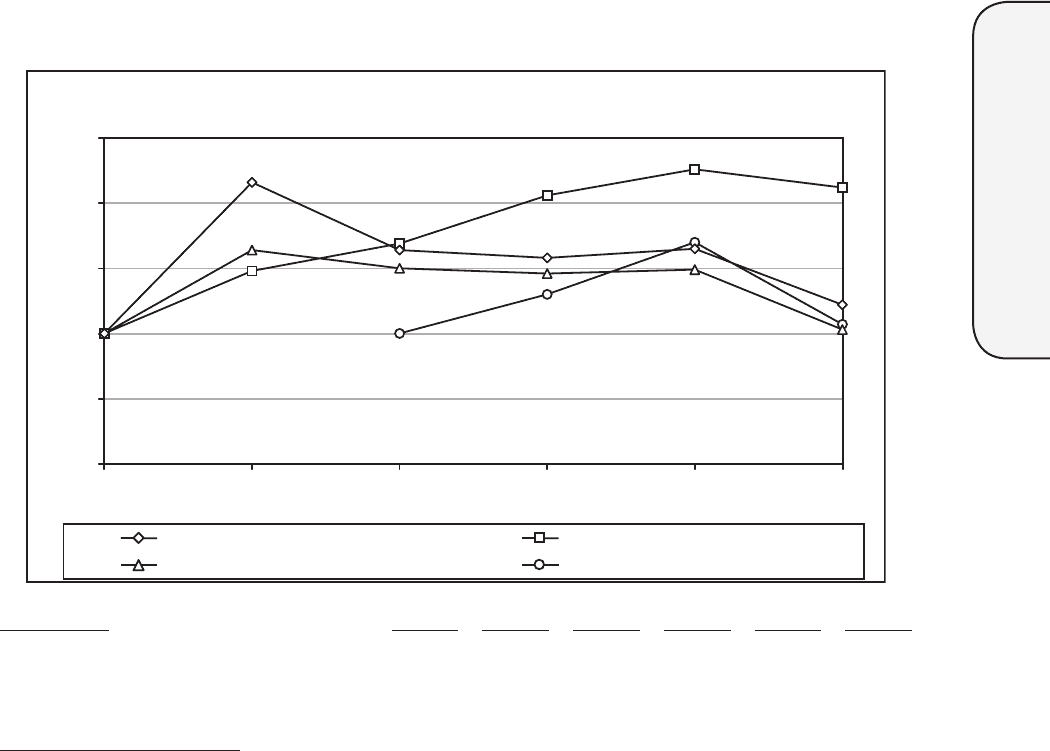

The following graph compares the cumulative total return on shares of Pep Boys Stock over the

past five years with the cumulative total return on shares of companies in (1) the Standard & Poor’s

SmallCap 600 Index, (2) the S&P 600 Specialty Stores Index and (3) the S&P 600 Automotive Retail

Index. Pep Boys moved from the S&P 600 Specialty Stores Index to the S&P 600 Automotive Retail

Index upon its formation in May 2005. Until such time as the S&P 600 Automotive Retail index has

five years of history, Pep Boys will show a comparison to both peer group indexes. The comparison

assumes that $100 was invested in January 2003 in Pep Boys Stock and in each of the indices and

assumes reinvestment of dividends. The companies currently comprising the S&P 600 Automotive

Retail Index are Group 1 Automotive, Inc.; Lithia Motors, Inc.; Midas, Inc.; Sonic Automotive, Inc.;

and The Pep Boys—Manny, Moe & Jack.

Comparison of Cumulative Five Year Total Return

$250

$200

$150

$100

$50

$0

Jan03 Jan04 Jan05 Jan06 Jan07 Jan08

Pep Boys

S&P 600 Specialty Stores Index

S&P SmallCap 600 Index

S&P 600 Automotive Retail Index

Company/Index Jan. 2003 Jan. 2004 Jan. 2005 Jan. 2006 Jan. 2007 Jan. 2008

Pep Boys ........................ $100 $216 $164 $158 $165 $122

S&P SmallCap 600 Index ............ $100 $148 $169 $206 $226 $212

S&P 600 Specialty Stores Index ....... $100 $164 $150 $146 $149 $103

S&P 600 Automotive Retail Index* ..... $100 $130 $170 $107

* The S&P 600 Automotive Retail Index was created in May 2005. Therefore, the total return for

January 2006 is for the period from May 2005 through January 2006.

15

10-K