Pep Boys 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

defined benefit pension plan and the unfunded defined benefit portion of the SERP, aggregate cash

contributions are expected to be $2,865,000 in fiscal 2008.

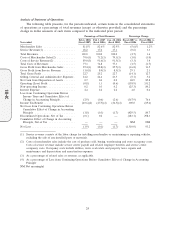

RESULTS OF OPERATIONS

The following discussion explains the material changes in our results of operations for the fifty-two

weeks ended February 2, 2008, the fifty-three weeks ended February 3, 2007 and fifty-two weeks ended

January 28, 2006.

Discontinued Operations

In the third quarter of fiscal 2007, we adopted our long-term strategic plan. One of the initial steps

in this plan was the identification of 31 low-return stores for closure. Immediately prior to their

ultimate closure during the fourth quarter of fiscal 2007, these stores were operated as clearance

centers. We are accounting for these store closures in accordance with the provisions of FASB

Statement of Financial Accounting Standards (SFAS) No. 146 ‘‘Accounting for Costs Associated with

Exit or Disposal Activities’’ and SFAS No. 144 ‘‘Accounting for Impairment or Disposal of Long-Lived

Assets.’’ We recorded charges of $15,551,000 related to store closures which included a $10,963,000

impairment charge to fixed assets. In accordance with SFAS No. 144, our discontinued operations for

all periods presented reflect the operating results for 11 of the 31 closed stores because we do not

believe that the customers of these stores are likely to become customers of other Pep Boys stores due

to geographical considerations. Discontinued operations for fiscal 2007 also reflect pre-tax charges of

$1,403,000 and $3,764,000 for store closure and impairment of fixed assets, respectively. The operating

results for the other 20 closed stores are included in continuing operations because we believe that the

customers of these stores are likely to become customers of other Pep Boys stores that are in close

proximity.

During fiscal 2005, we sold a closed store for proceeds of $916,000 resulting in a pre-tax gain of

$341,000, which was recorded in discontinued operations on the consolidated statement of operations.

The following analysis of our results of continuing operations excludes the operating results of the

above-referenced 11 stores which have been reclassified to discontinued operations for all periods

presented.

23

10-K