Pep Boys 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

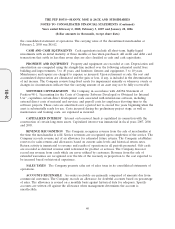

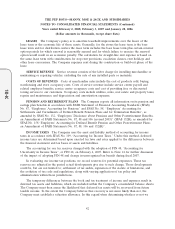

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2008, February 3, 2007 and January 28, 2006

(dollar amounts in thousands, except share data)

the consolidated statement of operations. The carrying value of the discontinued merchandise at

February 2, 2008 was $8,612.

CASH AND CASH EQUIVALENTS Cash equivalents include all short-term, highly liquid

investments with an initial maturity of three months or less when purchased. All credit and debit card

transactions that settle in less than seven days are also classified as cash and cash equivalents.

PROPERTY AND EQUIPMENT Property and equipment are recorded at cost. Depreciation and

amortization are computed using the straight-line method over the following estimated useful lives:

building and improvements, 5 to 40 years, and furniture, fixtures and equipment, 3 to 10 years.

Maintenance and repairs are charged to expense as incurred. Upon retirement or sale, the cost and

accumulated depreciation are eliminated and the gain or loss, if any, is included in the determination

of net income. The Company reviews long-lived assets for impairment annually or whenever events or

changes in circumstances indicate that the carrying amount of an asset may not be fully recoverable.

SOFTWARE CAPITALIZATION The Company, in accordance with AICPA Statement of

Position 98-1, ‘‘Accounting for the Costs of Computer Software Developed or Obtained for Internal

Use’’, capitalizes certain direct development costs associated with internal-use software, including

external direct costs of material and services, and payroll costs for employees devoting time to the

software projects. These costs are amortized over a period not to exceed five years beginning when the

asset is substantially ready for use. Costs incurred during the preliminary project stage, as well as

maintenance and training costs, are expensed as incurred.

CAPITALIZED INTEREST Interest on borrowed funds is capitalized in connection with the

construction of certain long-term assets. Capitalized interest was immaterial in fiscal years 2007, 2006

and 2005.

REVENUE RECOGNITION The Company recognizes revenue from the sale of merchandise at

the time the merchandise is sold. Service revenues are recognized upon completion of the service. The

Company records revenue net of an allowance for estimated future returns. The Company establishes

reserves for sales returns and allowances based on current sales levels and historical return rates.

Return activity is immaterial to revenue and results of operations in all periods presented. Gift cards

are recorded as deferred revenue until redeemed for product or services. The Company does not

record any revenue from cards which are never utilized by customers. Revenue from the sale of

extended warranties are recognized over the life of the warranty in proportion to the cost expected to

be incurred based on historical experience.

SALES TAXES The Company presents sales net of sales taxes in its consolidated statements of

operations.

ACCOUNTS RECEIVABLE Accounts receivable are primarily comprised of amounts due from

commercial customers. The Company records an allowance for doubtful accounts based on percentage

of sales. The allowance is revised on a monthly basis against historical data for adequacy. Specific

accounts are written off against the allowance when management determines the account is

uncollectible.

40

10-K