Pep Boys 2007 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2008, February 3, 2007 and January 28, 2006

(dollar amounts in thousands, except share data)

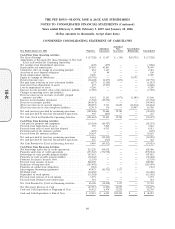

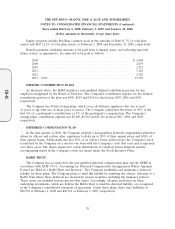

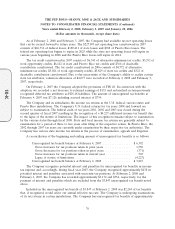

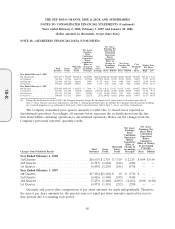

NOTE 14—INCOME TAXES

A reconciliation of the statutory federal income tax rate to the effective rate of the benefit for

income taxes follows:

Year ended

February 2, February 3, January 28,

2008 2007 2006

Statutory tax rate .............................. 35.0% 35.0% 35.0%

State income taxes, net of federal tax benefits .......... 3.1 (3.6) 0.9

Job credits ................................... 0.9 5.8 0.8

State deferred adjustment(a) ...................... — 18.2 —

FIN 48 adjustment ............................. 4.2 — —

Foreign taxes, net of federal benefits ................ 1.0 (3.8) —

Other, net ................................... (3.6) (4.1) (0.2)

40.6% 47.5% 36.5%

(a) The tax rate for the year ended February 2007 includes an adjustment to the state deferred liabilities

primarily due to change in the Company’s filing position in certain states. Based on the new filing

position, the Company has recorded certain tax attributes that were not recognized previously.

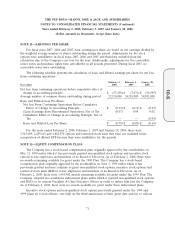

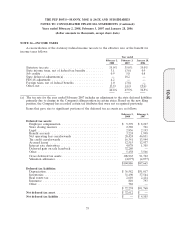

Items that gave rise to significant portions of the deferred tax accounts are as follows:

February 2, February 3,

2008 2007

Deferred tax assets:

Employee compensation ................................ $ 9,399 $ 8,227

Store closing reserves .................................. 2,388 741

Legal .............................................. 2,856 2,193

Benefit accruals ...................................... 3,224 1,998

Net operating loss carryforwards .......................... 20,424 46,831

Tax credit carryforwards ................................. 16,341 13,944

Accrued leases ....................................... 12,515 12,937

Interest rate derivatives ................................. 4,078 1,305

Deferred gain on sale leaseback ........................... 32,280 —

Other .............................................. 5,458 3,566

Gross deferred tax assets ................................ 108,963 91,742

Valuation allowance .................................... (4,077) (4,077)

$104,886 $87,665

Deferred tax liabilities:

Depreciation ......................................... $ 36,582 $51,017

Inventories .......................................... 31,490 37,544

Real estate tax ....................................... 2,610 2,414

Insurance ........................................... 810 793

Other .............................................. 782 —

$ 72,274 $91,768

Net deferred tax asset .................................... $ 32,612 $ —

Net deferred tax liability .................................. $ — $ 4,103

75

10-K