Pep Boys 2007 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2008, February 3, 2007 and January 28, 2006

(dollar amounts in thousands, except share data)

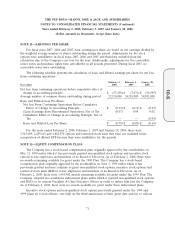

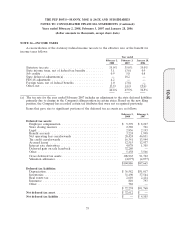

$2,374 for which it is reasonably possible that the amount will increase or decrease within the next

twelve months. However, based on the uncertainties associated with litigation and the status of

examination, it is not possible to estimate the impact of the change.

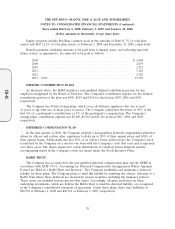

NOTE 15—CONTINGENCIES

During the fourth quarter of 2006 and the first quarter of 2007, the Company was served with four

separate lawsuits brought by former associates employed in California, each of which lawsuits purports

to be a class action on behalf of all current and former California store associates. One or more of the

lawsuits claim that the plaintiff was not paid for (i) overtime, (ii) accrued vacation time, (iii) all time

worked (i.e. ‘‘off the clock’’ work) and/or (iv) late or missed meal periods or rest breaks. The plaintiffs

also allege that the Company violated certain record keeping requirements arising out of the foregoing

alleged violations. The lawsuits (i) claim these alleged practices are unfair business practices,

(ii) request back pay, restitution, penalties, interest and attorney fees and (iii) request that the

Company be enjoined from committing further unfair business practices. During the third quarter of

2007, the Company reached a settlement in principle regarding the accrued vacation time claims (which

is scheduled to be considered by the court for final approval on May 5, 2008). The Company continues

to vigorously defend the remaining claims.

The Company is also party to various other actions and claims arising in the normal course of

business.

The Company believes that amounts accrued for awards or assessments in connection with all such

matters, which amounts were increased by $6,250 in fiscal 2007, are adequate and that the ultimate

resolution of these matters will not have a material adverse effect on the Company’s financial position.

However, there exists a reasonable possibility of loss in excess of the amounts accrued, the amount of

which cannot currently be estimated. While the Company does not believe that the amount of such

excess loss could be material to the Company’s financial position, any such loss could have a material

adverse effect on the Company’s results of operations in the period(s) during which the underlying

matters are resolved.

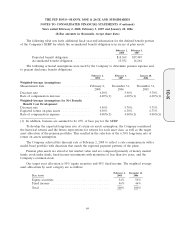

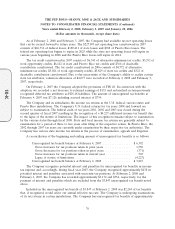

NOTE 16—INTEREST RATE SWAP AGREEMENT

On June 3, 2003, the Company entered into an interest rate swap for a notional amount of

$130,000. The Company had designated the swap as a cash flow hedge of the Company’s real estate

operating lease payments. The interest rate swap converts the variable LIBOR portion of the lease

payment to a fixed rate of 2.90% and terminates on July 1, 2008. If the critical terms of the interest

rate swap or hedge item do not change, the interest rate swap is considered to be highly effective with

all changes in fair value included in other comprehensive income. As of February 2, 2008 and

February 3, 2007, the fair value was an asset of $22 and $4,150, respectively, recorded within other

long-term assets on the balance sheet. In the fourth quarter of fiscal 2006, the Company determined it

was not in compliance with SFAS No. 133 for hedge accounting and, accordingly, recorded a reduction

of rent expense, which is included in Costs of Merchandise and Costs of Service Revenues, for the

cumulative fair value change of $4,150. This change in fair value had previously been recorded in

Accumulated Other Comprehensive Income (Loss) on the consolidated balance sheets. The Company

evaluated the impact of this error, along with three other errors discussed in the next sentence, on an

annual and quarterly basis and concluded there was no material impact on the fourth quarter of fiscal

77

10-K