Pep Boys 2007 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2008, February 3, 2007 and January 28, 2006

(dollar amounts in thousands, except share data)

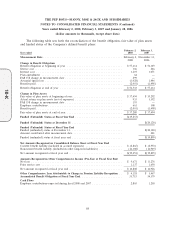

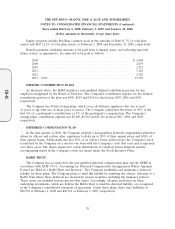

reconciliation of the beginning balance and ending carrying amounts of the Company’s asset retirement

obligation under SFAS 143 from January 28, 2006 through February 2, 2008:

Asset retirement obligation, January 28, 2006 ....................... $6,775

Asset retirement obligation incurred during the period .............. 131

Asset retirement obligation settled during the period ................ (130)

Accretion expense ......................................... 269

Asset retirement obligation, February 3, 2007 ....................... $7,045

Asset retirement obligation incurred during the period .............. 290

Asset retirement obligation settled during the period ................ (273)

Accretion expense ......................................... 284

Asset retirement obligation, February 2, 2008 ....................... $7,346

In the fourth quarter of fiscal 2005, the Company reviewed and revised its estimated settlement

costs. The Company reversed $1,945 of the liability as the original estimates of the contamination

occurrence rate and the cost to remediate such contaminations proved to be higher than actual

experience is yielding.

The Company adopted FIN 47, ‘‘Accounting for Conditional Asset Retirement Obligations,’’ an

interpretation of SFAS 143, ‘‘Asset Retirement Obligations’’ on January 28, 2006. This interpretation

impacted the Company in recognition of legal obligations associated with surrendering its leased

properties. These obligations were previously omitted from the Company’s SFAS 143 analysis due to

their uncertain timing. The impact of adopting FIN 47 was the recognition of net additional leasehold

improvement assets amounting to $470, an asset retirement obligation of $3,652 and a charge of $3,182

($2,021; net of tax), which was included in Cumulative Effect of Change in Accounting Principle in the

accompanying consolidated statement of operations for fiscal year 2005.

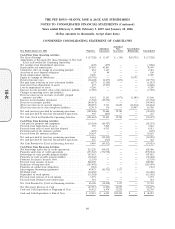

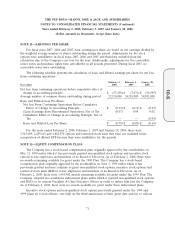

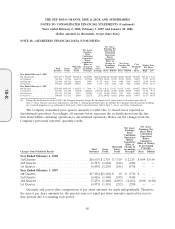

NOTE 14—INCOME TAXES

The (benefit) provision for income taxes includes the following:

Year ended

February 2, 2008 February 3, 2007 January 28, 2006

Current:

Federal .......................... $ (3,646) $ — $ —

State ............................ 654 933 1,008

Foreign .......................... 2,187 105 631

Deferred:

Federal .......................... (20,570) (4,745) (20,621)

State ............................ (3,761) (3,007) (1,306)

Foreign .......................... (458) 315 (739)

$(25,594) $(6,399) $(21,027)

74

10-K