Pep Boys 2007 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

(c) One-third of such RSUs vested/vest on each of March 13, 2008, 2009 and 2010.

(d) One-quarter of such options become exercisable on each of September 17, 2008, 2009, 2010 and 2011.

(e) One quarter of such RSUs vest on each of September 17, 2008, 2009, 2010 and 2011.

(f) All of such options became exercisable on March 3, 2008.

(g) One-half of such options became/become exercisable on February 25, 2008 and 2009.

(h) One-third of such options became/become exercisable on February 27, 2008, 2009 and 2010.

(i) One-quarter of such options became/become exercisable on each of February 15, 2008, 2009, 2010 and

2011.

(j) All of such RSUs vested on March 19, 2008.

(k) One-half of such RSUs vested/vest on each of March 18, 2008 and 2009.

(l) One-third of such RSUs vested/vest on each of February 27, 2008, 2009 and 2010.

(m) One-quarter of such RSUs vested/vest on each of February 15, 2008, 2009, 2010 and 2011.

(n) One-quarter of such RSUs vest on each of September 10, 2008, 2009, 2010 and 2011.

(o) All of such RSUs vested on March 3, 2008.

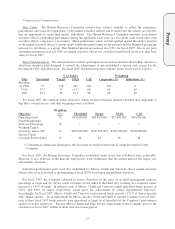

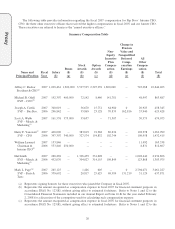

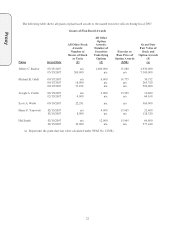

The following table shows information regarding stock options exercised by the named executive officers and

RSUs held by the named executive officers that vested, during fiscal 2007.

Option Exercises and Stock Vested Table

Option Awards Stock Awards

Name

Number of Shares

Acquired on

Exercise (#)

Value Realized on

Exercise ($)

Number of Shares

Acquired on

Vesting (#)(a)

Value Realized on

Vesting ($)(b)

Jeffrey C. Rachor -- -- 125,000 1,875,000

Joseph A. Cirelli 15,500 240,605 2,250 36,294

Harry F. Yanowitz -- -- 7,250 111,823

Hal Smith(c) 50,000 294,494 94,000 1,421,800

Mark L. Page 35,900 501,525 1,000 15,540

(a) Messrs. Rachor, Yanowitz and Page defer/deferred the issuance of vested shares underlying RSUs.

(b) Based upon the closing price of a share of PBY Stock on the vesting date(s) not the SFAS No. 123(R)

recognized compensation expense reflected elsewhere in this proxy statement.

(c) Pursuant to the terms of Mr. Smith’s Non-Competition Agreement, upon separation from the Company, all

then unvested RSUs (76,000) held by Mr. Smith were accelerated.

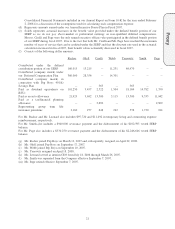

Pension Plans

Qualified Defined Benefit Pension Plan. We have a qualified defined benefit pension plan for all employees

hired prior to February 2, 1992. Future benefit accruals on behalf of all participants were frozen under this plan as

of December 31, 1996. Benefits payable under this plan are calculated based on the participant’s compensation

(base salary plus accrued bonus) over the last five years of the participant’s employment by Pep Boys and the

number of years of participation in the plan. Benefits payable under this plan are not subject to deduction for

Social Security or other offset amounts. The maximum annual benefit for any employee under this plan is $20,000.

Messrs. Cirelli and Page were the only named executive officers who participated in the qualified defined benefit

pension plan in fiscal 2007. Their accrued annualized benefits thereunder, at normal retirement age, were $15,063

and $19,162, respectively.

Executive Supplemental Retirement Plan. As discussed above, our SERP includes a defined benefit portion for

certain participants. Messrs. Cirelli and Page were the only named executive officers participating in the defined

benefit portion of the SERP in fiscal 2007. Benefits paid to a participant under the qualified defined pension plan

will be deducted from the benefits otherwise payable under the SERP. Except as described in the immediately

preceding sentence, benefits under the SERP are not subject to deduction for Social Security or other offset

amounts. Benefits under the SERP generally vest after four years of participation.

Proxy