Pep Boys 2007 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 9 CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

None.

ITEM 9A CONTROLS AND PROCEDURES

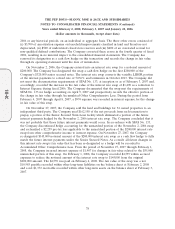

Disclosure Controls and Procedures The Company’s management evaluated, with the participation

of its principal executive officer and principal financial officer, the effectiveness of its disclosure

controls and procedures as of the end of the period covered by this report. Disclosure controls and

procedures mean the Company’s controls and other procedures that are designed to ensure that

information required to be disclosed by the Company in its reports that the Company files or submits

under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the

time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include,

without limitation, controls and procedures designed to ensure that information required to be

disclosed by the Company in its reports that the Company communicated to its management, including

its principal executive officer and principal financial officer, as appropriate to allow timely decisions

regarding required disclosure. The Company’s management recognizes that any controls and

procedures, no matter how well designed and operated, can only provide reasonable assurance of

achieving their objectives and management necessarily applies its judgment in evaluating the

cost-benefit relationship of possible controls and procedures. Based upon the evaluation of the

Company’s disclosure controls and procedures, as of the end of the period covered by this report, the

Company’s principal executive officer and principal financial officer concluded that, as of such date, the

Company’s disclosure controls and procedures were not effective at the reasonable assurance level,

solely due to the fact that there was a material weakness in our internal control over financial reporting

(which is a subset of disclosure controls and procedures) as described below.

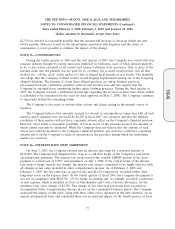

During the second quarter of fiscal 2007, the Company determined it had a material weakness in

its internal control over financial reporting related to preparation and review of the Company’s

supplemental guarantor information note and condensed consolidated statements of cash flows

presentation.

During the third quarter of fiscal 2007, the Company discovered that the impairment charge

related to the store closure portion of its five-year strategic plan should be recorded in the third

quarter instead of the fourth quarter as initially concluded. This resulted in the delayed filing with the

SEC of the Company’s Quarterly Report on Form 10-Q. The Company considered this error in

conjunction with the material weakness described above and concluded that the Company continued to

have, in the aggregate, a material weakness in the financial close and reporting process as of the end of

third quarter of fiscal 2007.

Since the conclusion of the second quarter of fiscal 2007, the Company has continued to

implement changes designed to enhance the effectiveness of its financial close and reporting process

including (i) hiring staff and providing additional accounting research resources, (ii) improving process

documentation and (iii) improving the review process by more senior accounting personnel. However,

as of February 2, 2008, the Company believes that its ongoing efforts to hire and train additional staff

are not yet complete as evidenced, in part, by the Company’s delayed filing of this Annual Report on

Form 10-K due to an error in the Company’s analyses and documentation supporting the realizability

of the Company’s net deferred tax asset. Accordingly, the Company cannot provide its constituents with

reasonable assurance that the material weakness in the financial close and reporting process has been

remediated.

Other than these changes, the Company made no other changes to its internal control over

financial reporting for the quarter ended February 2, 2008.

82

10-K