Pep Boys 2007 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

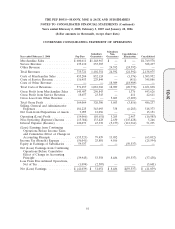

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2008, February 3, 2007 and January 28, 2006

(dollar amounts in thousands, except share data)

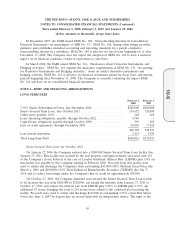

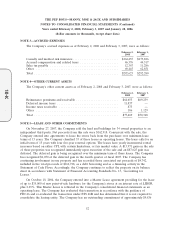

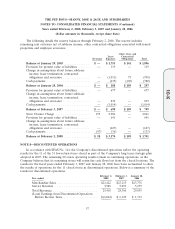

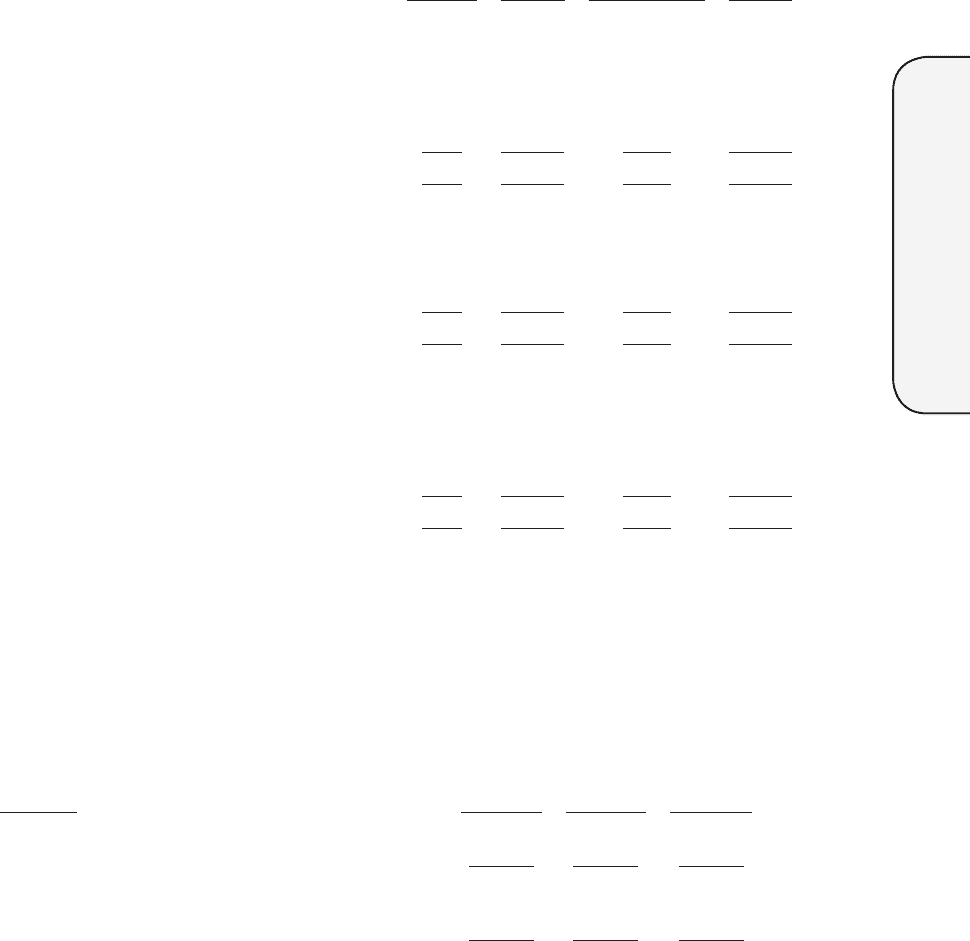

The following details the reserve balances through February 2, 2008. The reserve includes

remaining rent on leases net of sublease income, other contractual obligations associated with leased

properties and employee severance.

Other Costs and

Lease Contractual

Severance Expenses Obligations Total

Balance at January 29, 2005 .............. $ — $ 1,755 $ 141 $ 1,896

Provision for present value of liabilities ...... — 119 — 119

Change in assumptions about future sublease

income, lease termination, contractual

obligations and severance ............... — (1,011) 73 (938)

Cash payments ........................ — (675) (105) (780)

Balance at January 28, 2006 .............. $ — $ 188 $ 109 $ 297

Provision for present value of liabilities ...... — 677 — 677

Change in assumptions about future sublease

income, lease termination, contractual

obligations and severance ............... — 839 — 839

Cash payments ........................ — (1,014) — (1,014)

Balance at February 3, 2007 .............. $ — $ 690 $ 109 $ 799

Store Closure Charge ................... 155 2,906 — 3,061

Provision for present value of liabilities ...... — 641 — 641

Change in assumptions about future sublease

income, lease termination, contractual

obligations and severance ............... — (627) — (627)

Cash payments ........................ (97) (36) — (133)

Balance at February 2, 2008 .............. $ 58 $ 3,574 $ 109 $ 3,741

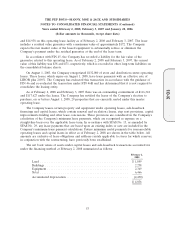

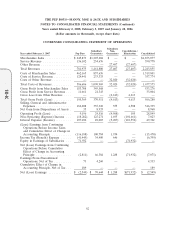

NOTE 8—DISCONTINUED OPERATIONS

In accordance with SFAS No. 144, the Company’s discontinued operations reflect the operating

results for the 11 of the 31 low-return stores closed as part of the Company’s long term strategic plan

adopted in 2007. The remaining 20 stores operating results remain in continuing operations, as the

Company believes that its remaining stores will retain the cash flows lost from the closed locations. The

results for the fiscal years ended February 3, 2007 and January 28, 2006 have been reclassified to show

the results of operations for the 11 closed stores in discontinued operations. Below is a summary of the

results for discontinued operations:

February 2, February 3, January 28,

Year ended 2008 2007 2006

Merchandise Sales ....................... $21,422 $23,213 $23,776

Service Revenue ........................ 3,988 5,093 5,279

Total Revenues ......................... 25,410 28,306 29,055

(Loss) Earnings from Discontinued Operations

Before Income Taxes ................... $(6,064) $ 6,129 $ 1,713

57

10-K