Pep Boys 2007 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

Company’s peer group and to compensate Mr. Odell for certain bonus awards and equity holdings that Mr. Odell

forfeited upon leaving his former employer.

Mr. Webb joined the Company on September 10, 2007. In order to induce Mr. Webb to join the Company, the

Human Resource Committee recommended, and the full board, approved (i) a base salary of $400,000, (ii) a target

annual bonus equal to 45% of his base salary (such bonus being guaranteed for fiscal 2007), (iii) participation in the

Company’s other incentive and welfare and benefit plans made available to executives, (iv) an inducement grant of

restricted stock units valued at $360,000 and (v) a signing bonus of $375,000. This compensation package was

designed by the Human Resources Committee to be competitive with those of the chief merchandising officers of

the Company’s peer group and to compensate Mr. Webb for certain bonus awards and equity holdings that Mr.

Webb forfeited upon leaving his former employer.

Interim Chief Executive Officer.

To appropriately compensate our Chairman of the Board for his services as Interim Chief Executive Officer,

from July 2006 through March 2007, we paid Mr. Leonard a monthly salary of $83,333 and reimbursed him for his

commuting expense, with a tax gross-up, from his home in California to our Philadelphia store support center.

Otherwise, Mr. Leonard did not receive or participate in any of our welfare, retirement or other benefit plans or

receive any perquisites. While Mr. Leonard served as interim CEO, he did not receive his customary cash

consideration on account of his service on the Board of Directors, but he did receive his customary equity grants

under our Stock Incentive Plan as a member of the Board. Mr. Leonard’s director compensation received in fiscal

2006 is not reflected in the named executive officer compensation tables below.

Former Executive Officers.

Mr. Smith was separated from the Company effective September 7, 2007. Pursuant to the terms of Mr. Smith’s

Non-Competition Agreement, Mr. Smith received a severance payment equal to two years’ base salary and the

accelerated vesting of all his then outstanding options and RSUs. Mr. Smith also became entitled to the

disbursement of his vested SERP balance.

Mr. Page retired from the Company effective September 7, 2007. Pursuant to the terms of Mr. Page’s Non-

Competition Agreement, Mr. Page received a severance payment equal to one and half years’ base salary. Mr. Page

also became entitled to the disbursement of his vested SERP balance.

While Messrs. Rachor and Yanowitz were both executive officers as of the end of fiscal 2007, both executive

officers subsequently resigned from the Company. Mr. Yanowitz announced his planned departure from the

Company on January 17, 2008. He resigned from the Company effective May 1, 2008. Mr. Rachor resigned from

the Company effective April 23, 2008.

Tax and Accounting Matters.

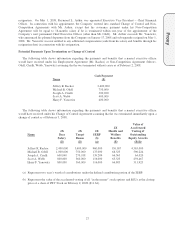

We consider the tax and accounting impact of each type of compensation in determining the appropriate

compensation structure. For tax purposes, annual compensation payable to the named executive officers generally

must not exceed $1 million in the aggregate during any year to be fully deductible under Section 162(m) of the

Internal Revenue Code. The Stock Incentive Plans are structured with the intention that stock option grants will

qualify as “performance based” compensation that is not subject to the $1 million deduction limit under Section

162(m). In addition, bonuses paid to the CEO under the Annual Incentive Bonus Plan qualify as “performance

based” compensation that is not subject to the $1 million deduction limit under Section 162(m). RSUs generally do

not qualify as “performance based” compensation for this purpose and are therefore subject to the $1 million

deduction limit. In order to compete effectively for the acquisition and retention of top executive talent, we believe

that we must have the flexibility to pay salary, bonus and other compensation that may not be fully deductible under

Section 162(m). Accordingly, the Human Resources Committee retains the authority to authorize payments that may

not be deductible under Section 162(m) if it believes that such payments are in the best interests of Pep Boys and

Proxy