Pep Boys 2007 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

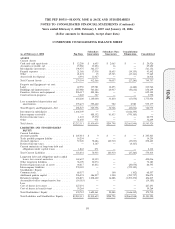

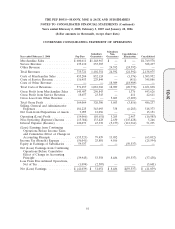

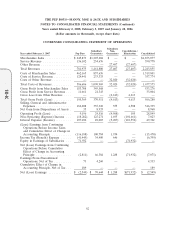

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2008, February 3, 2007 and January 28, 2006

(dollar amounts in thousands, except share data)

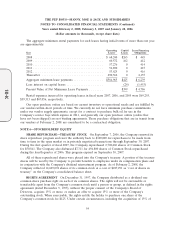

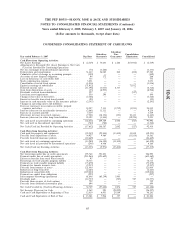

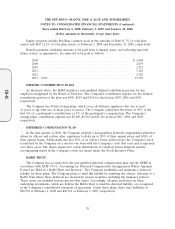

CONDENSED CONSOLIDATING STATEMENT OF CASH FLOWS

Subsidiary

Subsidiary Non- Consolidation

As of February 2, 2008 Pep Boys Guarantors Guarantors Elimination Consolidated

Cash Flows from Operating Activities:

Net (Loss) Earnings .............................. $(41,039) $ 51,051 $ 8,486 $(59,537) $ (41,039)

Adjustments to Reconcile Net (Loss) Earnings to Net Cash (Used

in) Provided By Continuing Operations:

Net loss (earnings) from discontinued operations ............ 1,094 2,507 — — 3,601

Depreciation and amortization ....................... 28,606 52,168 683 (421) 81,036

Amortization of deferred gain from asset sale .............. (718) (733) — 421 (1,030)

Accretion of asset disposal obligation ................... 96 180 — — 276

Stock compensation expense ......................... 9,756 — — — 9,756

Inventory impairment ............................. 12,413 20,390 — — 32,803

Equity in earnings of subsidiaries ...................... (59,537) — — 59,537 —

Deferred income taxes ............................ 11,550 (39,929) 192 — (28,187)

Gain from dispositions of assets ....................... (3,095) (12,056) — — (15,151)

Loss from asset impairment ......................... 1,772 5,427 — — 7,199

Change in fair value of derivatives ..................... 9,268 — — — 9,268

Dividends received from subsidiary ..................... 2,467 — — (2,467) —

Excess tax benefits from stock based awards ............... (1,104) — — — (1,104)

Increase in cash surrender value of life insurance policies ....... (4,928) — — — (4,928)

Changes in operating assets and liabilities:

(Increase) decrease in accounts receivable, prepaid expenses and

other ...................................... (6,238) (1,782) 6,896 (455) (1,579)

Increase in merchandise inventories .................... 57 13,030 — — 13,087

Decrease in accounts payable ........................ (20,066) — — — (20,066)

Increase (decrease) in accrued expenses .................. 20,932 107 (11,411) 455 10,083

(Decrease) increase in other long-term liabilities ............ (6,265) 3,041 — — (3,224)

Net cash (used in) provided by continuing operations ......... (44,979) 93,401 4,846 (2,467) 50,801

Net cash provided by discontinued operations .............. 659 1,324 — — 1,983

Net Cash (Used in) Provided by Operating Activities ......... (44,320) 94,725 4,846 (2,467) 52,784

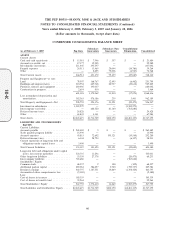

Cash Flows from Investing Activities:

Cash paid for property and equipment .................. (17,128) (25,988) — — (43,116)

Proceeds from dispositions of assets .................... 46,907 115,805 — — 162,712

Life insurance proceeds received ...................... 30,045 — — — 30,045

Net cash provided by continuing operations ............... 59,824 89,817 — — 149,641

Net cash (used in) discontinued operations ................ (108) (271) — — (379)

Net Cash Provided by Investing Activities ................. 59,716 89,546 — — 149,262

Cash Flows from Financing Activities:

Borrowings under line of credit agreements ............... 231,458 338,636 — — 570,094

Payments under line of credit agreements ................. (221,529) (324,088) (545,617)

Excess tax benefits from stock based awards ............... 1,104 — — — 1,104

Borrowings on trade payable program liability .............. 142,884 — — — 142,884

Payments on trade payable program liability ............... (142,620) — — — (142,620)

Payments for finance issuance costs .................... — (85) — — (85)

Proceeds from lease financing ........................ — 4,827 — — 4,827

Reduction of long-term debt ......................... (165,368) (41) — — (165,409)

Payments on capital lease obligations ................... (286) — — — (286)

Intercompany borrowings (payments) ................... 205,484 (204,811) (673) — —

Dividends paid ................................. (14,177) — (2,467) 2,467 (14,177)

Repurchase of common stock ........................ (58,152) — — — (58,152)

Proceeds from exercise of stock options .................. 3,652 — — — 3,652

Proceeds from dividend reinvestment plan ................ 781 — — — 781

Net Cash (Used in) Provided by Financing Activities .......... (16,769) (185,562) (3,140) 2,467 (203,004)

Net (Decrease) Increase in Cash ...................... (1,373) (1,291) 1,706 — (958)

Cash and Cash Equivalents at Beginning of Year ............ 13,581 7,946 357 — 21,884

Cash and Cash Equivalents at End of Year ................ $ 12,208 $ 6,655 $ 2,063 $ — $ 20,926

64

10-K