Pep Boys 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

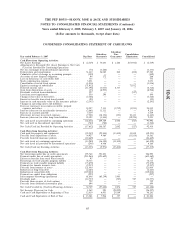

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2008, February 3, 2007 and January 28, 2006

(dollar amounts in thousands, except share data)

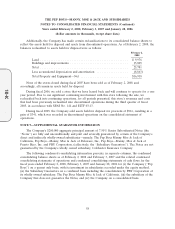

the Company’s stock by a person or group, the rights entitle the holder to purchase common stock of

the Company or common stock of an acquiring company having a market value of twice the exercise

price of the right.

The rights do not have voting power and are subject to redemption by the Company’s Board of

Directors for $.01 per right anytime before a 15% position has been acquired and for 10 days

thereafter, at which time the rights become non-redeemable. The rights expired on December 31, 2007.

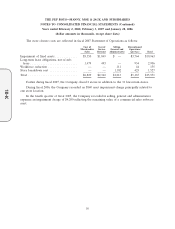

BENEFITS TRUST On April 29, 1994, the Company established a flexible employee benefits

trust with the intention of purchasing up to $75,000 worth of the Company’s common shares. The

repurchased shares will be held in the trust and will be used to fund the Company’s existing benefit

plan obligations including healthcare programs, savings and retirement plans and other benefit

obligations. The trust will allocate or sell the repurchased shares through 2023 to fund these benefit

programs. As shares are released from the trust, the Company will charge or credit additional paid-in

capital for the difference between the fair value of shares released and the original cost of the shares to

the trust. For financial reporting purposes, the trust is consolidated with the accounts of the Company.

All dividend and interest transactions between the trust and the Company are eliminated. In

connection with the Dutch Auction self-tender offer, 37,230 shares were tendered at a price of $16.00

per share in fiscal 1999. At February 2, 2008, the Company has reflected 2,195,270 shares of its

common stock at a cost of $59,264 as ‘‘cost of shares in benefits trust’’ on the Company’s consolidated

balance sheet.

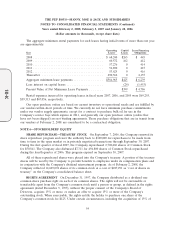

NOTE 7—STORE CLOSURES AND ASSET IMPAIRMENTS

In the third quarter of fiscal 2007, the Company adopted a long-term strategic plan. One of the

initial steps in this plan was the identification of 31 low-return stores for closure. Immediately prior to

their ultimate closures during the fourth quarter of fiscal 2007, these stores were operated as clearance

centers. The Company is accounting for these store closures in accordance with the provisions of SFAS

No. 146 ‘‘Accounting for Costs Associated with Exit or Disposal Activities’’ and SFAS No. 144

‘‘Accounting for the Impairment or Disposal of Long-Lived Assets.’’

The Company recorded charges of $15,551 related to store closures which included a $10,963

impairment charge to fixed assets, $2,906 in long-term lease and other related obligations, net of

subleases, $155 in workforce reduction costs, and store breakdown costs of $1,527. The impairment of

fixed assets includes the adjustment to the market value of those owned stores that are now classified

as assets held for disposal in accordance with SFAS No. 144 and the impairment of leasehold

improvements. The assets held for disposal have been valued at the lower of their carrying amount or

their estimated fair value, net of disposal costs. The long-term lease and other related obligations

represent the fair value of such obligations less the estimated net sublease income.

55

10-K