NetSpend 2014 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

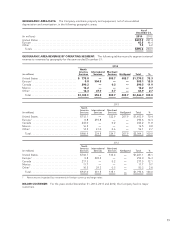

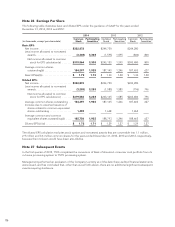

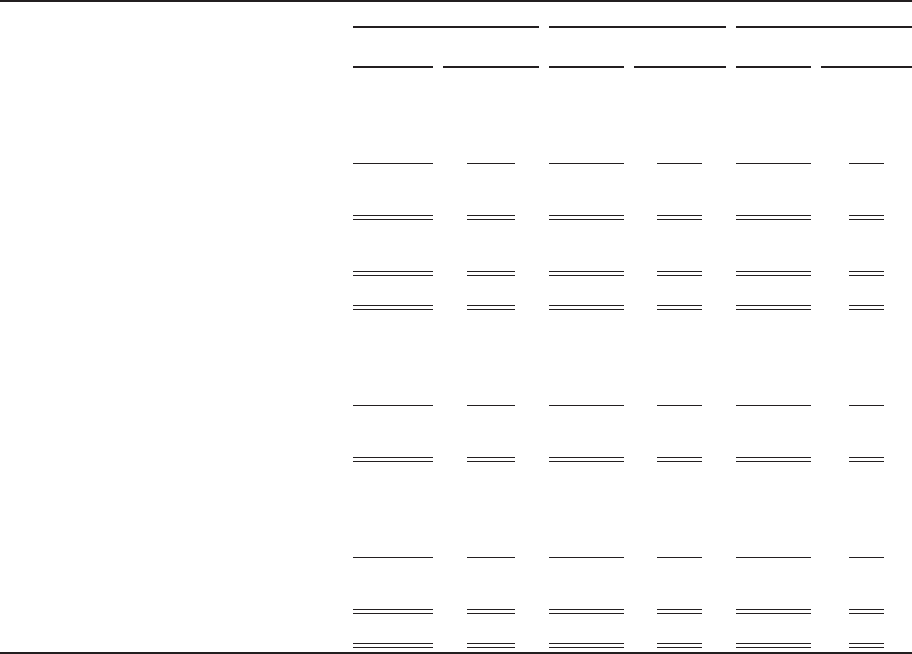

Note 26 Earnings Per Share

The following table illustrates basic and diluted EPS under the guidance of GAAP for the years ended

December 31, 2014, 2013 and 2012:

2014 2013 2012

(in thousands, except per share data)

Common

Stock Participating

Securities Common

Stock Participating

Securities Common

Stock Participating

Securities

Basic EPS:

Net income ........................ $322,872 $244,750 $244,280

Less income allocated to nonvested

awards .......................... (3,308) 3,308 (1,595) 1,595 (800) 800

Net income allocated to common

stock for EPS calculation(a) ....... $319,564 3,308 $243,155 1,595 $243,480 800

Average common shares

outstanding(b) .................... 184,297 1,925 187,145 1,246 187,403 627

Basic EPS(a)/(b) ..................... $ 1.73 1.72 $ 1.30 1.28 $ 1.30 1.28

Diluted EPS:

Net income ........................ $322,872 $244,750 $244,280

Less income allocated to nonvested

awards .......................... (3,288) 3,288 (1,585) 1,585 (796) 796

Net income allocated to common

stock for EPS calculation(c) ....... $319,584 3,288 $243,165 1,585 $243,484 796

Average common shares outstanding . . 184,297 1,925 187,145 1,246 187,403 627

Increase due to assumed issuance of

shares related to common equivalent

shares outstanding ................ 1,459 1,648 1,262

Average common and common

equivalent shares outstanding(d) .... 185,756 1,925 188,793 1,246 188,665 627

Diluted EPS(c)/(d) ................... $ 1.72 1.71 $ 1.29 1.27 $ 1.29 1.27

The diluted EPS calculation excludes stock options and nonvested awards that are convertible into 1.1 million,

2.9 million and 3.6 million common shares for the years ended December 31, 2014, 2013 and 2012, respectively,

because their inclusion would have been anti-dilutive.

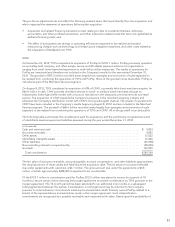

Note 27 Subsequent Events

In the first quarter of 2015, TSYS completed the conversion of Bank of America’s consumer card portfolio from its

in-house processing system to TSYS’ processing system.

Management performed an evaluation of the Company’s activity as of the date these audited financial statements

were issued, and has concluded that, other than as set forth above, there are no additional significant subsequent

events requiring disclosure.

86