NetSpend 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

shares. Effective February 1, 2010 and March 5, 2012, no additional awards may be made from the Total System

Services, Inc. 2000 and 2002 Long-Term Incentive Plans, respectively.

Share-Based Compensation

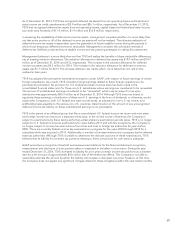

Share-based compensation costs are classified as selling, general and administrative expenses on the Company’s

statements of income and corporate administration and other expenses for segment reporting purposes. TSYS

does not include amounts associated with share-based compensation as costs capitalized as software

development and contract acquisition costs as these awards are typically granted to individuals not involved in

capitalizable activities. For the year ended December 31, 2014, share-based compensation was $30.8 million

compared to $28.9 million and $18.6 million for the same periods in 2013 and 2012, respectively.

Nonvested Awards: The Company granted shares of TSYS common stock to certain key employees and non-

management members of its Board of Directors. The grants to certain key employees were issued under

nonvested stock bonus awards for services to be provided in the future by such officers and employees. The

grants to the Board of Directors were fully vested on the date of grant.

On July 1, 2013, the Company issued 870,361 shares of TSYS common stock as nonvested stock replacement

awards with a market value of $21.5 million as part of the NetSpend acquisition. The nonvested stock bonus

awards to employees of NetSpend are for services to be provided in the future and vest over varying periods.

The NetSpend awards were converted into equivalent shares of Company’s common stock on the acquisition

date. The value of the stock at the date of issuance is charged as compensation expense over the vesting periods

of the awards.

On July 18, 2013, the Company issued 212,694 retention shares of TSYS common stock with a market value of

$5.5 million to certain key employees of NetSpend. The nonvested stock bonus awards to certain key employees

are for services to be provided in the future and vest over periods ranging from two to four years. The market

value of the TSYS common stock at the date of issuance is charged as compensation expense over the vesting

periods of the awards.

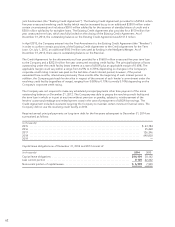

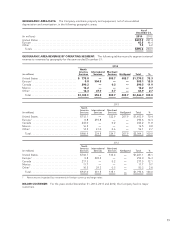

The following table summarizes the number of shares granted each year:

2014 2013 2012

Number of shares ...................................................... 672,724 1,667,246 310,690

Market value (in millions) ................................................ $ 20.6 41.3 6.7

A summary of the status of TSYS’ nonvested shares as of December 31, 2014, 2013 and 2012 and the changes

during the periods are presented below:

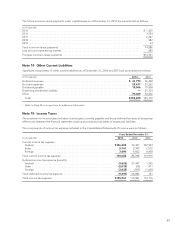

2014 2013 2012

Nonvested shares

(in thousands, except per share data) Shares

Weighted

Average

Grant-Date

Fair Value Shares

Weighted

Average

Grant-Date

Fair Value Shares

Weighted

Average

Grant-Date

Fair Value

Outstanding at beginning of year ............. 1,783 $24.19 554 $19.96 618 $16.80

Granted .................................. 673 30.67 1,667124.75 311 21.47

Vested .................................... (602) 23.74 (328) 19.95 (366) 15.91

Forfeited/canceled ......................... (85) 25.47 (110) 23.82 (9) 19.85

Outstanding at end of year ................... 1,769 $26.75 1,783 $24.19 554 $19.96

1 Includes the issuance of approximately 870,361 stock replacement awards in connection with the acquisition of NetSpend

in 2013. These awards had a market value of $21.5 million. A portion of the expense associated with these options has

been included as a component of the total purchase price of the NetSpend acquisition. Refer to Note 24.

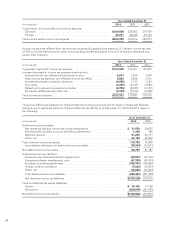

As of December 31, 2014, there was approximately $30.5 million of total unrecognized compensation cost

related to nonvested share-based compensation arrangements. That cost is expected to be recognized over a

remaining weighted average period of 2.0 years.

71