NetSpend 2014 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Stock Repurchase Plan

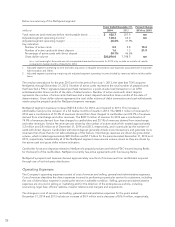

In April 2010, TSYS announced a stock repurchase plan to purchase up to 10 million shares of TSYS stock. The

shares may be purchased from time to time over the next two years at prices considered attractive to the

Company. In May 2011, TSYS announced that its Board had approved an increase in the number of shares that

may be repurchased under its current share repurchase plan from up to 10 million shares to up to 15 million

shares of TSYS stock. The expiration date of the plan was also extended to April 30, 2013. In July 2012, TSYS

announced that its Board had approved an increase in the number of shares that may be repurchased under its

current share repurchase plan from up to 15 million shares to up to 20 million shares of TSYS stock. The

expiration date of the plan was also extended to April 30, 2014. In January, 2014, TSYS announced that its Board

had approved an increase in the number of shares that may be repurchased under its current share repurchase

plan from up to 20 million shares to up to 28 million shares of TSYS stock. With the increase, TSYS had 6.8 million

shares available to be repurchased. In addition, the expiration date of the plan was extended to April 30, 2015.

Through December 31, 2014, the Company purchased 21.2 million shares for approximately $503.3 million, at an

average price of $23.75.

On January 27, 2015, TSYS announced that its Board had approved a new stock repurchase plan to repurchase

up to 20 million shares of TSYS stock. The shares may be purchased from time to time at prices considered

appropriate. There is no expiration date for the plan. The plan discussed in the preceding paragraph was

terminated.

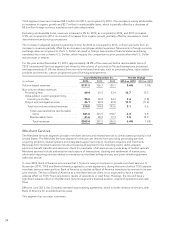

Dividends

Dividends on common stock of $74.8 million were paid in 2014, compared to $56.5 million and $94.0 million in

2013 and 2012, respectively. The Company paid dividends of $0.40 per share in 2014, $0.30 per share in 2013

and $0.50 per share in 2012. The decrease in dividends paid in 2013 compared to 2012 is due to the acceleration

of payment of the fourth quarter 2012 dividend. The fourth quarter 2012 dividend payment was paid in

December, rather than January, to allow shareholders to benefit from the lower dividend tax rate that was set to

expire on December 31, 2012.

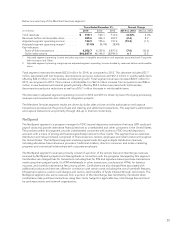

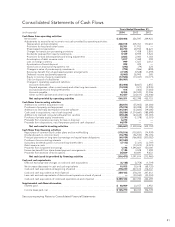

Significant Noncash Transactions

During 2014, 2013 and 2012, the Company issued 673,000, 1.7 million and 311,000 shares of common stock,

respectively, to certain key employees and non-management members of its Board of Directors. The grants to

certain key employees were issued in the form of nonvested stock bonus awards for services to be provided in

the future by such officers and employees. The grants to the Board of Directors were fully vested on the date of

grant. The market value of the common stock at the date of issuance is amortized as compensation expense over

the vesting period of the awards.

The Company acquired computer equipment and software under capital leases in the amount of $17.9 million,

$14.8 million and $5.3 million in 2014, 2013 and 2012, respectively.

Refer to Notes 19 and 23 in the Consolidated Financial Statements for more information on share-based

compensation and significant noncash transactions.

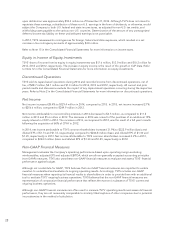

Additional Cash Flow Information

Off-Balance Sheet Financing

TSYS uses various operating leases in its normal course of business. These “off-balance sheet” arrangements

obligate TSYS to make payments for computer equipment, software and facilities. These computer and software

lease commitments may be replaced with new lease commitments due to new technology. Management expects

that, as these leases expire, they will be evaluated and renewed or replaced by similar leases based on need.

34