NetSpend 2014 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We’ve entered a world where payments blend into

the background without friction. In this new world,

consumers rule the day

—

and the status quo is not

sufficient. Amidst all this change, we differentiate

ourselves in the market through our brand promise

of People-Centered Payments. Every process,

product, new technology or acquisition we make

delivers on this higher purpose: to improve lives

and businesses while putting people at the center

of payments.

However, People-Centered Payments isn’t just a brand

promise

—

it is the guiding principle of the growth

strategy for our company. By putting people at the

center of every decision we make, we can offer

innovative products and solutions that are most

sought-after by our clients and their customers.

2014 was a year full of opportunity to deliver on

this promise to financial institutions, businesses and

consumers. But before we get into that, we’d like to

share our thoughts and reflections on the year’s

financial results as a whole.

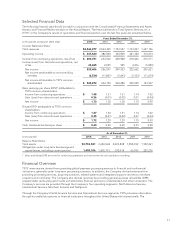

2014 Results

This was a year of tremendous growth, and our

performance was strong. We truly believe this is a

result of our core business strength, robust organic

growth, a steady stream of new clients and an overall

healthy economy for card usage.

• Revenue and Income: Total revenues were $2.4

billion, an increase of 18.5%. Revenues before

reimbursable items* were $2.2 billion, an increase

of 20.2%.

• Earnings Per Share: Adjusted earnings per share*

(EPS) was $1.96, an increase of 13.2%. Adjusted

EBITDA* was $712.3 million, an increase of 14.1%.

Basic EPS from continuing operations was $1.48,

which was an increase of 12.8%. Diluted EPS

from continuing operations was $1.47, an

increase of 12.9%.

• Return to Shareholders: Net income attributable

to common shareholders was $322.9 million, an

increase of 31.9%. Our closing stock price at year

end was $33.96, and our total shareholder return

was 3.2%. We purchased 5.2 million shares of

our stock for $165.3 million and intend to

repurchase more in 2015.

Our success is tied to our issuers’ growth, the health

of the businesses we serve and the consumers who

choose our products. Furthermore, we think of TSYS as

a payments platform company with industrial-strength

systems for financial institutions, businesses and

consumers

—

a combination that is unique in the

payments industry. While scale and distribution net-

works are benefits of these platforms, they ultimately

provide the foundation and seamless interface that

allow us to work with independent software vendors

and providers to offer services not otherwise readily

available to our clients. These healthy financial results

are largely attributed to the strength of our issuer

processing, along with our direct acquiring and

prepaid program-management capabilities. Having

2