NetSpend 2014 Annual Report Download - page 68

Download and view the complete annual report

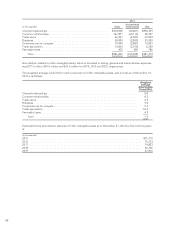

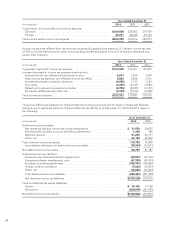

Please find page 68 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As of December 31, 2014, TSYS had recognized deferred tax assets from net operating losses and federal and

state income tax credit carryforwards of $5.9 million and $26.1 million, respectively. As of December 31, 2013,

TSYS had recognized deferred tax assets from net operating losses, capital losses and federal and state income

tax credit carry forwards of $11.4 million, $1.9 million and $10.8 million, respectively.

In assessing the realizability of deferred income tax assets, management considers whether it is more likely than

not that some portion or all of the deferred income tax assets will not be realized. The ultimate realization of

deferred income tax assets is dependent upon the generation of future taxable income during the periods in

which those temporary differences become deductible. Management considers the scheduled reversal of

deferred tax liabilities, projected future taxable income and tax planning strategies in making this assessment.

Management believes it is more likely than not that TSYS will realize the benefits of these deductible differences,

net of existing valuation allowances. The valuation allowance for deferred tax assets was $19.0 million and $14.7

million as of December 31, 2014 and 2013, respectively. The increase in the valuation allowance for deferred

income tax assets was $4.3 million for 2014. The increase in the valuation allowance for deferred income tax

assets was $1.7 million for 2013. The increase relates to tax credits which, more likely than not, will not be

realized in later years.

TSYS has adopted the permanent reinvestment exception under GAAP, with respect to future earnings of certain

foreign subsidiaries. As a result, TSYS considers foreign earnings related to these foreign operations to be

permanently reinvested. No provision for U.S. federal and state incomes taxes has been made in the

consolidated financial statements for those non-U.S. subsidiaries whose earnings are considered to be reinvested.

The amount of undistributed earnings considered to be “reinvested” which may be subject to tax upon

distribution was approximately $90.3 million as of December 31, 2014. Although TSYS does not intend to

repatriate these earnings, a distribution of these non-U.S. earnings in the form of dividends, or otherwise, would

subject the Company to both U.S. federal and state income taxes, as adjusted for non-U.S. tax credits, and

withholding taxes payable to the various non-U.S. countries. Determination of the amount of any unrecognized

deferred income tax liability on these undistributed earnings is not practicable.

TSYS is the parent of an affiliated group that files a consolidated U.S. federal income tax return and most state

and foreign income tax returns on a separate entity basis. In the normal course of business, the Company is

subject to examinations by these taxing authorities unless statutory examination periods lapse. TSYS is no longer

subject to U.S. federal income tax examinations for years before 2011 and with few exceptions, the Company is

no longer subject to income tax examinations from state and local or foreign tax authorities for years before

2005. There are currently federal income tax examinations in progress for the years 2009 through 2012 for a

subsidiary which was acquired in 2013. Additionally, a number of tax examinations are in progress by the relevant

state tax authorities. Although TSYS is unable to determine the ultimate outcome of these examinations, TSYS

believes that its liability for uncertain tax positions relating to these jurisdictions for such years is adequate.

GAAP prescribes a recognition threshold and measurement attribute for the financial statement recognition,

measurement and disclosure of a tax position taken or expected to be taken in a tax return. During the year

ended December 31, 2014, TSYS increased its liability for prior year uncertain income tax positions as a discrete

item by a net amount of approximately $4.0 million (net of the federal tax effect). The Company is not able to

reasonably estimate the amount by which the liability will increase or decrease over time; however, at this time,

the Company does not expect any significant changes related to these obligations within the next twelve months.

65