NetSpend 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

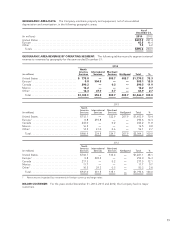

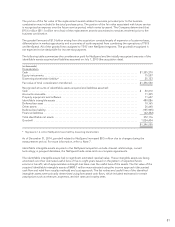

Note 20 Treasury Stock

The following table summarizes shares held as treasury stock and their related carrying value as of December 31:

(in thousands)

Number of

Treasury

Shares Treasury

Shares Cost

2014 ..................................................................... 17,836 $453,230

2013 ..................................................................... 15,073 326,996

2012 ..................................................................... 15,440 287,301

Stock Repurchase Plan

On April 20, 2010, TSYS announced a stock repurchase plan to purchase up to 10 million shares of TSYS stock.

The shares may be purchased from time to time over the next two years at prices considered attractive to the

Company. On May 3, 2011, TSYS announced that its Board had approved an increase in the number of shares

that may be repurchased under its current share repurchase plan from up to 10 million shares to up to 15 million

shares of TSYS stock. On July 24, 2012, TSYS announced that its Board had approved an increase in the number

of shares that may be repurchased under its current share repurchase plan from up to 15 million shares to up to

20 million shares of TSYS stock. The expiration date of the plan was also extended to April 30, 2014. During

2014, the Company purchased 5.2 million shares for approximately $165.3 million, at an average price of $31.79.

During 2013, the Company purchased 3.1 million shares for approximately $97.6 million, at an average price of

$31.48. During 2012, the Company purchased 3.2 million shares for approximately $74.6 million, at an average

price of $23.31. In January 2014, the TSYS Board approved an increase in the number of shares that may be

repurchased under its current share repurchase plan from up to 20 million shares to up to 28 million shares of

TSYS stock. With the increase, TSYS had 12.0 million shares available to be repurchased. In addition, the

expiration date of the plan was extended to April 30, 2015.

On January 27, 2015, TSYS announced that its Board had approved a new stock repurchase plan to purchase up

to 20 million shares of TSYS stock. The shares may be purchased from time to time at prices considered

appropriate. There is no expiration date for the plan. The plan discussed in the preceding paragraph was

terminated.

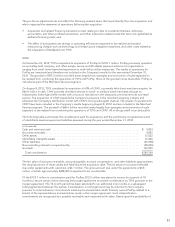

The following table sets forth information regarding the Company’s purchases of its common stock on a monthly

basis during the three months ended December 31, 2014:

(in thousands, except per share data)

Total Number

of Shares

Purchased Average Price

Paid per Share

Total Number of

Cumulative shares Purchased

as Part of Publicly

announced Plans or

Programs

Maximum

Number of

Shares That

May Yet Be

Purchased

Under the Plans

or Programs

October 2014 ................. — $ — 19,693 8,307

November 2014 ............... 850 32.88 20,543 7,457

December 2014 ............... 650 33.35 21,193 6,807

Total ...................... 1,500 $33.08

Treasury Shares

In 2008, the Compensation Committee approved “share withholding for taxes” for all employee nonvested

awards, and also for employee stock options under specified circumstances. The dollar amount of the income tax

liability from each exercise is converted into TSYS shares and withheld at the statutory minimum. The shares are

added to the treasury account and TSYS remits funds to the Internal Revenue Service to settle the tax liability.

During 2014 and 2013, the Company acquired 162,489 shares for approximately $5.2 million and acquired

264,383 shares for approximately $6.3 million, respectively, as a result of share withholding for taxes.

75