NetSpend 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

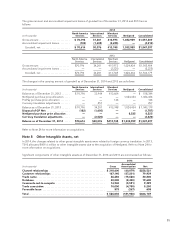

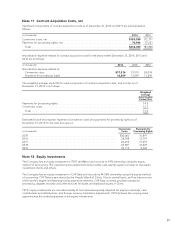

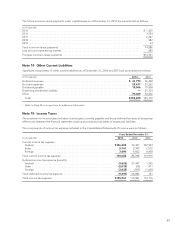

2013

(in thousands) Gross Accumulated

Amortization Net

Channel relationships ............................................. $318,600 (20,261) $298,339

Customer relationships ............................................ 167,871 (69,114) 98,757

Trade name ..................................................... 46,561 (6,527) 40,034

Database ....................................................... 28,000 (2,800) 25,200

Covenants-not-to-compete ........................................ 14,940 (2,887) 12,053

Trade association ................................................. 10,000 (3,750) 6,250

Favorable lease .................................................. 875 (89) 786

Total ....................................................... $586,847 (105,428) $481,419

Amortization related to other intangible assets, which is recorded in selling, general and administrative expenses,

was $77.3 million, $50.0 million and $16.6 million for 2014, 2013 and 2012, respectively.

The weighted average useful life for each component of other intangible assets, and in total, as of December 31,

2014 is as follows:

Weighted

Average

Amortization

Period (Yrs)

Channel relationships ................................................................. 8.0

Customer relationships ................................................................ 8.2

Trade name ......................................................................... 4.9

Database ........................................................................... 5.0

Covenants-not-to-compete ............................................................ 5.3

Trade association .................................................................... 10.0

Favorable Lease ..................................................................... 4.9

Total ........................................................................... 7.6

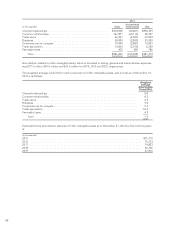

Estimated future amortization expense of other intangible assets as of December 31, 2014 for the next five years

is:

(in thousands)

2015 .................................................................................. $75,770

2016 .................................................................................. 75,213

2017 .................................................................................. 74,823

2018 .................................................................................. 60,166

2019 .................................................................................. 47,870

56