NetSpend 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

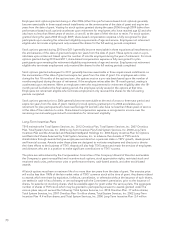

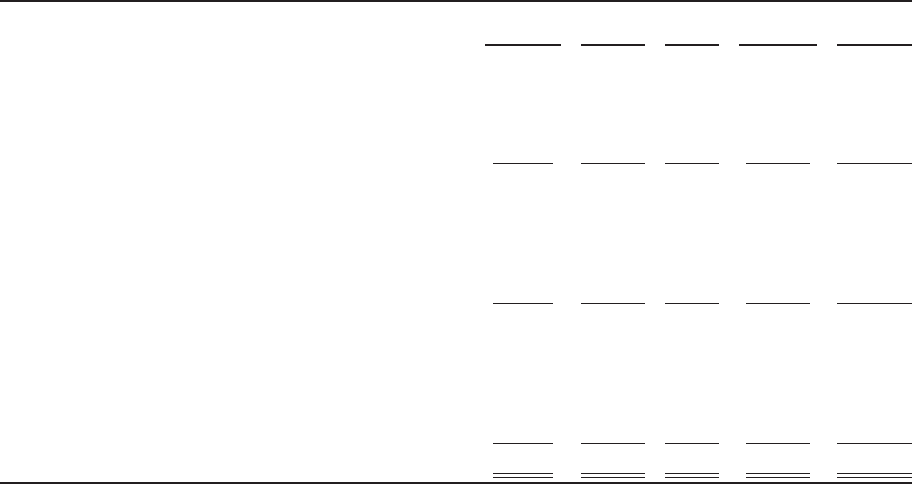

Note 21 Other Comprehensive Income (Loss)

Comprehensive income (loss) for TSYS consists of net income, cumulative foreign currency translation

adjustments, unrealized gain on available for sale securities and the recognition of an overfunded or underfunded

status of a defined benefit postretirement plan recorded as a component of shareholders’ equity. The income tax

effects allocated to and the cumulative balance of each component of accumulated other comprehensive income

(loss) are as follows:

(in thousands)

Beginning

Balance Pretax

amount Tax

effect Net-of-tax Ending

Balance

As of December 31, 2011 ........................... $(2,585) 5,397 3,257 2,140 $ (445)

Foreign currency translation adjustments .............. $ (186) 4,875 1,357 3,518 $ 3,332

Transfer from noncontrolling interest (NCI) ............. 28 — — — 28

Change in accumulated other comprehensive income

(AOCI) related to postretirement healthcare plans ..... (287) (2,603) (938) (1,665) (1,952)

As of December 31, 2012 ........................... $ (445) 2,272 419 1,853 $ 1,408

Foreign currency translation adjustments .............. $3,332 (295) 1,033 (1,328) $ 2,004

Transfer from NCI ................................. 28 — — — 28

Gain on available for sale securities ................... — 2,810 1,037 1,773 1,773

Change in AOCI related to postretirement healthcare

plans .......................................... (1,952) 1,926 30 1,896 (56)

As of December 31, 2013 ........................... $1,408 4,441 2,100 2,341 $ 3,749

Foreign currency translation adjustments ............ $2,004 (17,143) (1,547) (15,596) $(13,592)

Transfer from NCI ................................ 28 — — — 28

Gain on available for sale securities ................. 1,773 (1,058) (390) (668) 1,105

Change in AOCI related to postretirement healthcare

plans .......................................... (56) 921 332 589 533

As of December 31, 2014 .......................... $3,749 (17,280) (1,605) (15,675) $(11,926)

Consistent with its overall strategy of pursuing international investment opportunities, TSYS adopted the

permanent reinvestment exception under GAAP, with respect to future earnings of certain foreign subsidiaries. Its

decision to permanently reinvest foreign earnings offshore means TSYS will no longer allocate taxes to foreign

currency translation adjustments associated with these foreign subsidiaries accumulated in other comprehensive

income.

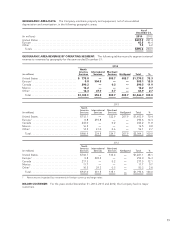

Note 22 Segment Reporting, including Geographic Area Data and Major Customers

TSYS provides global payment processing and other services to card-issuing and merchant acquiring institutions

in the United States and internationally through online accounting and electronic payment processing systems.

Corporate expenses, such as finance, legal, human resources, mergers and acquisitions and investor relations are

categorized as Corporate Administration.

In the first quarter of 2014, the Company’s Japan-based entities qualified for discontinued operations treatment.

In July 2013, TSYS completed its acquisition of all the outstanding stock of NetSpend, which previously operated

as a publicly traded company. NetSpend’s financial results are included in the NetSpend segment.

In December 2012, TSYS completed its acquisition of all the outstanding stock of ProPay, a privately-held

payment solutions company. ProPay’s financial results are included in the Merchant Services segment.

In August 2012, TSYS completed its acquisition of 60% of CPAY, a privately held direct merchant acquirer.

CPAY’s financial results are included in the Merchant Services segment. In February, 2014, the Company

purchased an additional 15% equity interest in CPAY.

Refer to Note 24 for more information on acquisitions.

76