NetSpend 2014 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Major Customer

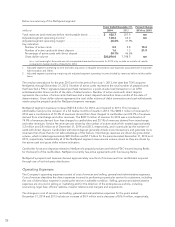

The Company works to maintain a large and diverse customer base across various industries. Although the

Company does not have a major customer on a consolidated basis, a significant amount of the Company’s

revenues are derived from long-term contracts with large clients. TSYS derives revenues from providing various

processing and other services to these clients, including processing of consumer and commercial accounts, as

well as revenues for reimbursable items. The loss of one of the Company’s large clients could have a material

adverse effect on the Company’s financial position, results of operations and cash flows.

Refer to Note 22 in the Consolidated Financial Statements for more information on major customers.

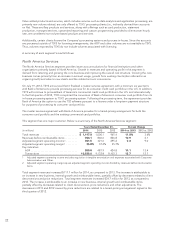

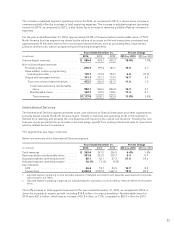

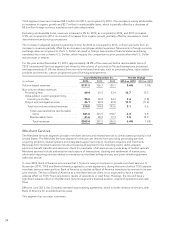

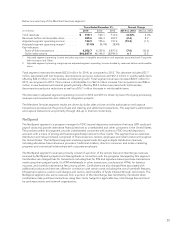

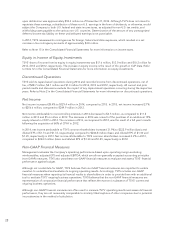

Operating Segments

TSYS’ services are provided through four operating segments: North America Services, International Services,

Merchant Services and NetSpend.

The Company’s North America Services and International Services segments have many long-term customer

contracts with card issuers providing account processing and output services for printing and embossing items.

These contracts generally require advance notice prior to the end of the contract if a client chooses not to renew.

Additionally, some contracts may allow for early termination upon the occurrence of certain events such as a

change in control. The termination fees paid upon the occurrence of such events are designed primarily to cover

balance sheet exposure related to items such as capitalized conversion costs or client incentives associated with

the contract and, in some cases, may cover a portion of lost future revenue and profit. Although these contracts

may be terminated upon certain occurrences, the contracts provide the segment with a steady revenue stream

since a vast majority of the contracts are honored through the contracted expiration date.

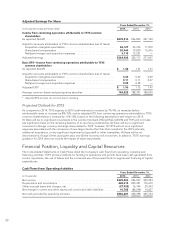

These services are provided throughout the period of each account’s use, starting from a card-issuing client

processing an application for a card. Services may include processing the card application, initiating service for

the cardholder, processing each card transaction for the issuing retailer or financial institution and accumulating

the account’s transactions. Fraud management services monitor the unauthorized use of accounts which have

been reported to be lost, stolen, or which exceed credit limits. Fraud detection systems help identify fraudulent

transactions by monitoring each account holder’s purchasing patterns and flagging unusual purchases. Other

services provided include customized communications to cardholders, information verification associated with

granting credit, debt collection, and customer service.

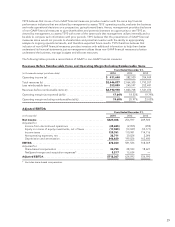

TSYS’ revenues in its North America Services and International Services segments are derived from electronic

payment processing. There are certain basic core services directly tied to accounts on file and transactions. These

are provided to all of TSYS’ processing clients. The core services begin with an account on file.

The core services include housing an account on TSYS’ system (AOF), authorizing transactions (authorizations),

accumulating monthly transactional activity (transactions) and providing a monthly statement (statement

generation). From these core services, TSYS’ clients also have the option to use fraud and portfolio management

services. Collectively, these services are considered volume-based revenues.

Non-volume related revenues include processing fees which are not directly associated with AOF and

transactional activity, such as value added products and services, custom programming and certain other

services, which are only offered to TSYS’ processing clients.

21