NetSpend 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The pro forma adjustments do not reflect the following material items that result directly from the acquisition and

which impacted the statement of operations following the acquisition:

• Acquisition and related financing transactions costs relating to fees to investment bankers, attorneys,

accountants, and other professional advisors, and other transaction-related costs that were not capitalized as

deferred financing costs; and

• The effect of anticipated cost savings or operating efficiencies expected to be realized and related

restructuring charges such as technology and infrastructure integration expenses, and other costs related to

the integration of NetSpend into TSYS.

2012

On December 26, 2012, TSYS completed its acquisition of ProPay for $123.7 million. ProPay previously operated

as a privately-held company, and offers simple, secure and affordable payment solutions for organizations

ranging from small, home based entrepreneurs to multi-billion dollar enterprises. The results of operations for

ProPay are immaterial and therefore not included in the Company’s results for the year ended December 31,

2012. The goodwill of $93.5 million recorded arises largely from synergies and economies of scale expected to

be realized from combining the operations of TSYS and ProPay. None of the goodwill is tax deductible. ProPay is

included as part of the Merchant Services segment.

On August 8, 2012, TSYS completed its acquisition of 60% of CPAY, a privately held direct merchant acquirer, for

$66.0 million in cash. CPAY provides merchant services to small- to medium-sized merchants through an

Independent Sales Agent (ISA) model, with a focus on merchants in the restaurant, personal services and retail

sectors. The acquisition of CPAY expands the Company’s presence in the merchant acquiring industry and

enhances the Company’s distribution model with CPAY’s strong sales agent channel. The results of operations for

CPAY have been included in the Company’s results beginning August 8, 2012, and are included in the Merchant

Services segment. The goodwill of $68.6 million recorded arises largely from synergies and economies of scale

expected to be realized from combining the operations of TSYS and CPAY. All of the goodwill is tax deductible.

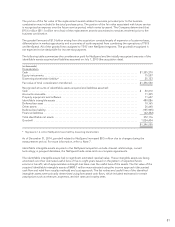

The following table summarizes the consideration paid for acquisitions and the preliminary recognized amounts

of identifiable assets acquired and liabilities assumed during the year ended December 31, 2012.

(in thousands)

Cash and restricted cash ................................................................. $ 3,003

Accounts receivable ..................................................................... 4,092

Other assets ........................................................................... 12,522

Identifiable intangible assets ............................................................. 76,600

Other liabilities ......................................................................... (30,558)

Noncontrolling interest in acquired entity ................................................... (38,000)

Goodwill .............................................................................. 162,090

Total consideration ................................................................... $189,749

The fair value of accounts receivable, accounts payable, accrued compensation, and other liabilities approximates

the carrying amount of those assets and liabilities at the acquisition date. The fair value of accounts receivable

due under agreements with customers is $4.1 million. The gross amount due under the agreements is $4.8

million, of which approximately $688,000 is expected to be uncollectible.

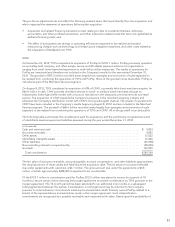

Of the $123.7 million in consideration paid for ProPay, $12.5 million was placed in escrow for a period of 18

months to secure certain claims that may be brought against the escrowed consideration by TSYS pursuant to the

merger agreement. The 18-month period has been extended for an additional nine months in a subsequent

tolling agreement between the parties. Consideration is contingent and may be returned to the Company

pursuant to indemnification commitments made by the shareholders which formerly owned ProPay related to a

breach of the representations and warrantees made in the merger agreement. Such indemnification

commitments are recognized as a possible receivable and measured at fair value. Based upon the probability of

83