NetSpend 2014 Annual Report Download - page 22

Download and view the complete annual report

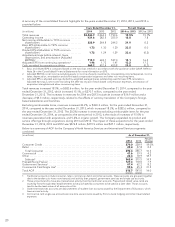

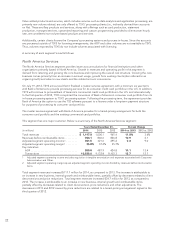

Please find page 22 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.reimbursable items are impacted with changes in postal rates and changes in the volumes of mailing activities by

its clients. Reimbursable items for the year ended December 31, 2014, were $253.9 million, an increase of $13.3

million or 5.5% compared to $240.6 million for the same period last year. Reimbursable items for the year ended

December 31, 2013 decreased $11.9 million, or 4.7%, compared to $252.5 million for the same period in 2012.

TSYS’ revenues are generated from charges based on the number of accounts on file (AOF), transactions and

authorizations processed, statements mailed, cards embossed and mailed, and other processing services for

cardholder AOF. Cardholder AOF include active and inactive consumer credit, retail, prepaid, stored value,

government services and commercial card accounts.

TSYS’ revenues in its North America Services and International Services segments are influenced by several

factors, including volumes related to AOF and transactions. TSYS estimates that approximately 47.2% of these

segments’ revenues is AOF and transaction volume driven. The remaining 52.8% of payment processing

revenues are not AOF and transaction volume driven, and are derived from production and optional services

TSYS considers to be value added products and services, custom programming and licensing arrangements.

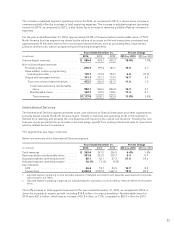

Whether or not an account on file is active can impact TSYS’ revenues differently. Active accounts are accounts

that have had monetary activity either during the current month or in the past 90 days based on contractual

definition. Inactive accounts are accounts that have not had a monetary transaction (such as a purchase or

payment) in the past 90 days. The more active an account is, the more revenue is generated for TSYS (items such

as transactions and authorizations processed and statements billed).

Occasionally, a client will purge inactive accounts from its portfolio. An inactive account typically will only

generate an AOF charge. A processing client will periodically review its cardholder portfolio based upon activity

and usage. Each client, based upon criteria individually set by the client, will flag an account to be “purged” from

TSYS’ system and deactivated.

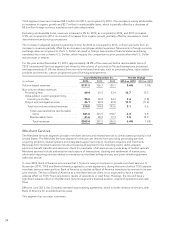

A deconversion involves a client migrating all of its accounts to an in-house solution or another processor.

Account deconversions include active and inactive accounts and can impact the Company’s revenues significantly

more than an account purge.

A sale of a portfolio typically involves a client selling a portion of its accounts to another party. A sale of a

portfolio and a deconversion impact the Company’s financial statements in a similar fashion, although a sale

usually has a smaller financial impact due to the number of accounts typically involved.

TSYS’ revenues in its Merchant Services segment are influenced by several factors, including volumes related to

transactions and dollar sales volume, which are approximately 92.6% of this segment’s revenues. The remaining

7.4% of Merchant Services’ revenues are derived from value added services, monthly statement fees, compliance

fees, and miscellaneous services.

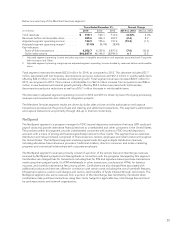

TSYS’ revenues in its NetSpend segment primarily consist of a portion of the service fees and interchange

revenues received by NetSpend’s prepaid card Issuing Banks in connection with the programs managed by

NetSpend. For the year ended December 31, 2014, 70.3% of revenues was derived from fees charged to

cardholders and 29.7% of revenues was derived from interchange and other revenues. Service fee revenues are

driven by the number of active cards, and in particular by the number of cards with direct deposit. Cardholders

with direct deposit generally initiate more transactions and generate more revenues than those that do not take

advantage of this feature. Interchange revenues are driven by gross dollar volume. Substantially all of the

NetSpend segment’s revenues are volume driven as they are driven by the active card and gross dollar volume

indicators.

19