NetSpend 2014 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

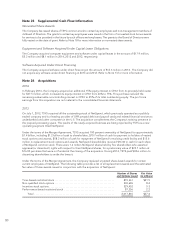

Note 23 Supplemental Cash Flow Information

Nonvested Share Awards

The Company has issued shares of TSYS common stock to certain key employees and non-management members of

its Board of Directors. The grants to certain key employees were issued in the form of nonvested stock bonus awards

for services to be provided in the future by such officers and employees. The grants to the Board of Directors were

fully vested on the date of grant. Refer to Note 18 for more information on nonvested share awards.

Equipment and Software Acquired Under Capital Lease Obligations

The Company acquired computer equipment and software under capital leases in the amount of $17.9 million,

$5.3 million and $8.1 million in 2014, 2013 and 2012, respectively.

Software Acquired Under Direct Financing

The Company acquired software under direct financing in the amount of $13.6 million in 2014 . The Company did

not acquire any software under direct financing in 2013 and 2012. Refer to Note 13 for more information.

Note 24 Acquisitions

2014

In February 2014, the Company acquired an additional 15% equity interest in CPAY from its privately held owner

for $37.5 million, which increased its equity interest in CPAY from 60% to 75%. This purchase reduced the

remaining redeemable noncontrolling interest in CPAY to 25% of its total outstanding equity. The pro forma

earnings from this acquisition are not material to the consolidated financial statements.

2013

On July 1, 2013, TSYS acquired all the outstanding stock of NetSpend, which previously operated as a publicly

traded company and is a leading provider of GPR prepaid debit and payroll cards and related financial services to

underbanked and other consumers in the U.S. The acquisition complements the Company’s existing presence in

the prepaid processing space. The results of the newly acquired business are being reported by TSYS as a new

operating segment titled NetSpend.

Under the terms of the Merger Agreement, TSYS acquired 100 percent ownership of NetSpend for approximately

$1.4 billion, including $1.2 billion of cash to shareholders, $70.7 million of cash for payment to holders of vested

stock options and awards, $58.3 million of cash for repayment of NetSpend’s revolving credit facility and $15.6

million in replacement stock options and awards. NetSpend shareholders received $16.00 in cash for each share

of NetSpend common stock. There were 1.6 million NetSpend shares held by five shareholders who asserted

appraisal (or dissenters’) rights with respect to their NetSpend shares, for a preliminary value of $25.7 million at

$16.00 per share that were not funded at the closing of the acquisition. During 2014, TSYS paid $38.6 million to

dissenting shareholders to settle the lawsuit.

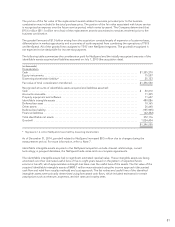

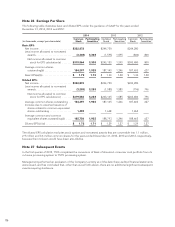

Under the terms of the Merger Agreement, the Company replaced unvested share-based awards for certain

current employees of NetSpend. The following table provides a list of all replacement awards and the estimated

fair value of those awards issued in conjunction with the acquisition of NetSpend:

Number of Shares

and Options Issued Fair Value

(in millions)

Time-based restricted stock ............................................ 870,361 $21.5

Non-qualified stock options ............................................ 530,696 8.4

Incentive stock options ................................................ 529,452 5.3

Performance-based restricted stock ..................................... 87,356 2.2

Total ........................................................... 2,017,865 $37.4

80