NetSpend 2014 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

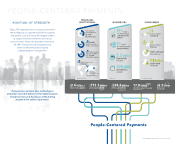

It’s a new era — for both our company and the industry,

but TSYS’ core mission remains the same —

to support payments that revolve around people.

end-to-end payment solutions under one roof has

been the pinnacle of our acquisition strategy over

the past few years. As part of this bundle of offerings,

we have more to offer financial institutions, businesses

and consumers. Skills in one business can be leveraged

across the enterprise, and our overall expertise in pay-

ments

—

along with the skill and scale in technology

—

can be utilized across all of these sectors.

This mix also leads to a more balanced portfolio of

customers for overall stability and growth. In this

business, there are cycles, and ups and downs are

not always predictable. Regardless of fluctuations

in any one particular segment, our company’s

overall stability and performance are solid.

We’d now like to address each of the constituents

we serve

—

financial institutions, businesses and

consumers

—

and share how we’ve utilized

People-Centered Payments for growth in each

of these key areas.

Financial Institutions

In 2014, we had a healthy client roster of strong

financial institutions. Conversions like TD Bank Group®

brought us millions of new accounts to fuel a core

growth that supports our overall business. We are

proud to say that in early 2015, we completed the

Bank of America® conversion

—

the largest conversion

in the history of payments. This conversion required

the utmost dedication from our team members and

positions our company for tremendous growth.

2014 has been a year of many high-profile breaches.

This has forced financial institutions and businesses

to accelerate the speed at which they are adopting

security measures. To this end, our plug-and-play

tokenization offering fits the mold. Called TSYS

Enterprise TokenizationSM, it supports secure

transactions via a mobile device and facilitates

enablement for issuers, merchants and app

developers in processing transactions. In September

2014, we announced this tokenization solution in

conjunction with the services it provides for a

secure way to pay through Apple Pay™

—

more

on this later.

Digitally active consumers

—

those accustomed to

navigating their daily lives with smartphones, tablets,

game systems and computers

—

want a choice in the

way they pay for goods and services, from traditional

plastic to mobile phones, or through any other device

of their choosing. In the UK, we partnered with

PayPal® to offer an installment loan plan at the point

of sale (POS) using PayPal accounts. We see

—

and

seize

—

opportunities to further diversify beyond

credit to offer broader and more varied products

that best meet consumers’ needs for alternative ways

to pay. Our near-term pipeline across TS2®, TSYS

Managed ServicesSM EMEA and PRIMESM licensing is

1

—

This conve

ar-te

vices

SM

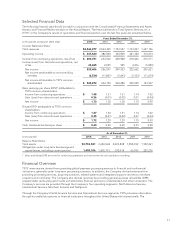

*Revenues before reimbursable items, adjusted EBITDA and adjusted earnings per share are non-GAAP financial measures,

which are explained further on pages 26-27 of this report.

3