NetSpend 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

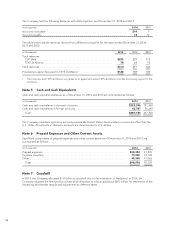

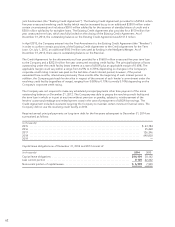

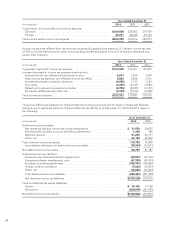

The future minimum lease payments under capital leases as of December 31, 2014 are summarized as follows:

(in thousands)

2015 .................................................................................. $ 7,355

2016 .................................................................................. 3,554

2017 .................................................................................. 2,627

2018 .................................................................................. 987

2019 .................................................................................. 63

Total minimum lease payments ............................................................ 14,586

Less amount representing interest .......................................................... 485

Principal minimum lease payments ......................................................... $14,101

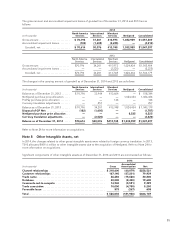

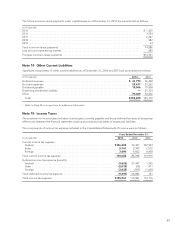

Note 14 Other Current Liabilities

Significant components of other current liabilities as of December 31, 2014 and 2013 are summarized as follows:

(in thousands) 2014 2013

Deferred revenues ............................................................ $ 41,773 36,408

Accrued expenses ............................................................. 23,617 23,265

Dividends payable ............................................................ 19,006 19,508

Dissenting shareholder liability1................................................. —25,723

Other ....................................................................... 70,409 54,266

Total ...................................................................... $154,805 159,170

1Refer to Note 24 on acquisitions for additional information.

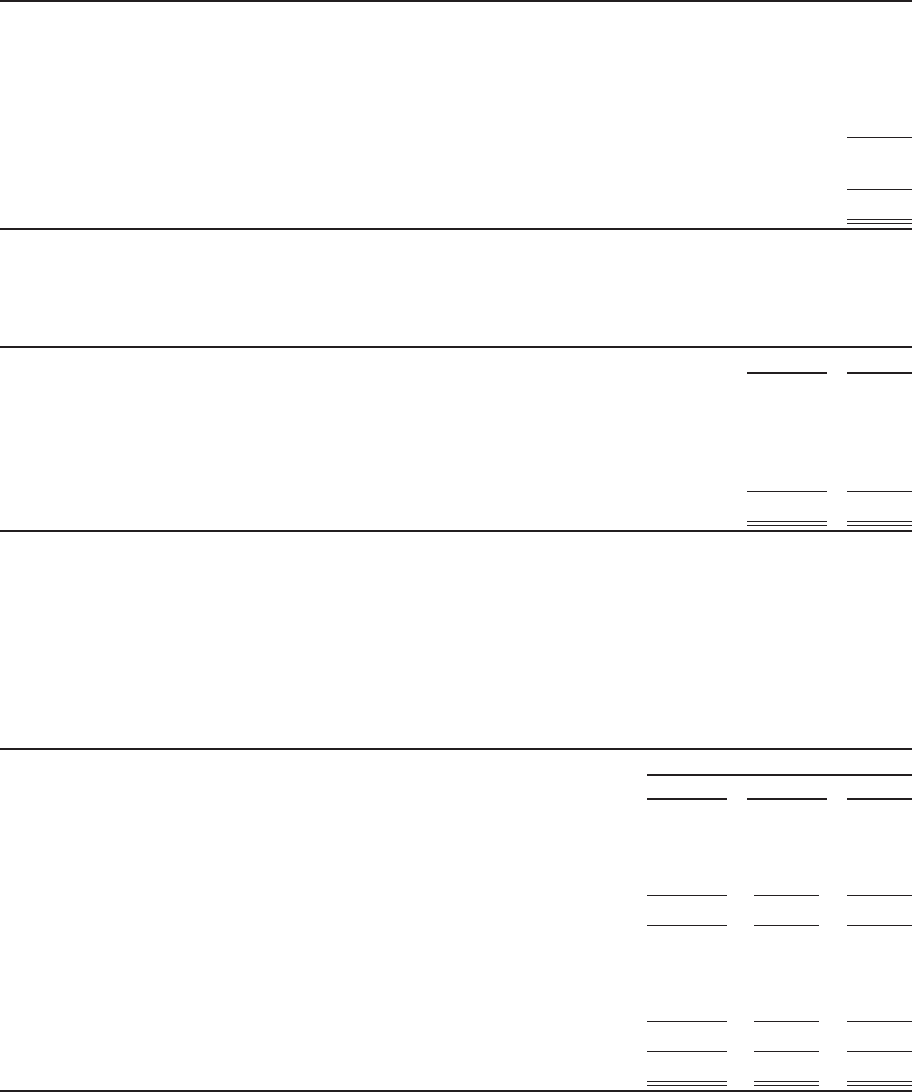

Note 15 Income Taxes

The provision for income taxes includes income taxes currently payable and those deferred because of temporary

differences between the financial statement carrying amounts and tax bases of assets and liabilities.

The components of income tax expense included in the Consolidated Statements of Income were as follows:

Years Ended December 31,

(in thousands) 2014 2013 2012

Current income tax expense:

Federal ......................................................... $126,203 74,327 102,953

State ........................................................... 5,161 2,949 2,572

Foreign ......................................................... 7,694 6,822 8,450

Total current income tax expense ..................................... 139,058 84,098 113,975

Deferred income tax expense (benefit):

Federal ......................................................... (3,623) 27,447 1,395

State ........................................................... (2,039) (55) 411

Foreign ......................................................... (3,635) (509) (1,665)

Total deferred income tax expense .................................... (9,297) 26,883 141

Total income tax expense ............................................ $129,761 110,981 114,116

63