NetSpend 2014 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

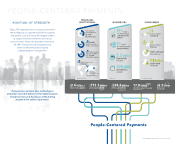

*Juniper Research, Digital Payments Strategies Online, Mobile & Contactless 2014-2019, published June 24, 2014.

encouraging, and we will continue to engage

actively with existing clients and new prospects to

give consumers the solutions best designed for them.

Entering 2015, we will continue to fine-tune our sales

activities and areas of focus to ensure we drive future

quality revenue and margins internationally.

Digital innovation is core to our issuing and acquiring

clients’ strategies, and we’re making it easy to access

third-platform technologies like mobile, social, big data

and the cloud. We’re also making the omnichannel

experience seamless no matter which communication

method consumers choose. Our business and IT

strategy

—

Surround®

—

announced in November

2014 will power the next generation of digital

innovation through a suite of new technology and

product offerings. It will also provide our issuing clients

a better way to manage their business and service

their customers. Surround brings into play more

open platforms accessible to third parties using

application program interfaces and other tools,

resulting in greater flexibility to exponentially

enhance the customer experience

—

a prime

example of People-Centered Payments in action.

Businesses

Putting people at the center of our business means

providing them a choice in the way they pay,

while paying keen attention to important issues

such as safety and security. We supported this goal

by implementing chip cards in the United States

and beyond based on EMV standards. In light

of the October 2015 liability shift deadline for

merchants to accept EMV payments, we are

ramping up our capacity to produce EMV cards

as market demand increases. We have also

been communicating with merchants about

what the upcoming EMV timeline means and

what action they must take.

By understanding our clients and their customers’

needs, we help them grow their business with

integrated services that deliver more value and

gives them a better understanding of their business

landscape. We saw traction in sales of some of

our value-added products like TSYS Merchant

InsightsSM, which provides merchants with analytics

in card-based revenue, transaction history, online

reputation monitoring, social media activity and

competitor benchmarking.

Another landmark in 2014 was our support of Apple

Pay as a partner for merchants, app developers and

issuing banks. This required agility and industry

leadership, which allowed us to join the ranks of the

industry’s most influential stakeholders to make this

new innovative payment method a reality. Apple Pay

stands to redefine consumers’ relationships with

the POS, and payment card information will be more

secure and private for purchases made in apps and

via near-field communication (NFC)-enabled POS

terminals. In 2014, commerce initiated with mobile

phones and tablets is expected to total $114 billion

in the United States alone, according to Juniper

Research*

—

numbers that indicate an opportunity

to expand and heighten our role in the digital market-

place. While still in the early stages, we believe Apple

Pay will help drive further innovation across the industry

and allow us to capture more payments that currently

are made with cash and checks.

We believe that in the future, merchant service

providers will become much more specialized,

with solutions that focus on merchant verticals to

4