NetSpend 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RECLASSIFICATIONS: Certain reclassifications have been made to the 2013 and 2012 financial statements to

conform to the presentation adopted in 2014.

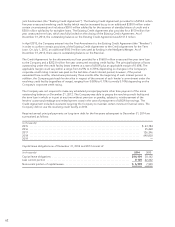

Note 2 Discontinued Operations

In accordance with GAAP, the Company determined its Japan-based businesses became discontinued

operations in the first quarter of 2014.

The Company sold all of its stock of GP Network Corporation (GP Net) (representing 54% ownership of the

company) and all of its stock of TSYS Japan Godo Kaisha (TSYS Japan) (representing 100% ownership of the

company) in April 2014. Both entities were part of the International Services segment. The sale of the Company’s

stock in both of its operations in Japan was the result of management’s decision during the first quarter of 2014,

to divest non-strategic businesses and focus resources on core products and services. The Company had a gain

of $48.6 million, net of tax, related to the sales of its operations in Japan.

GP Net and TSYS Japan were not significant components of TSYS’ consolidated results.

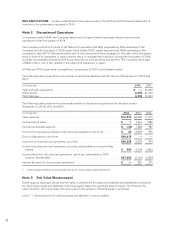

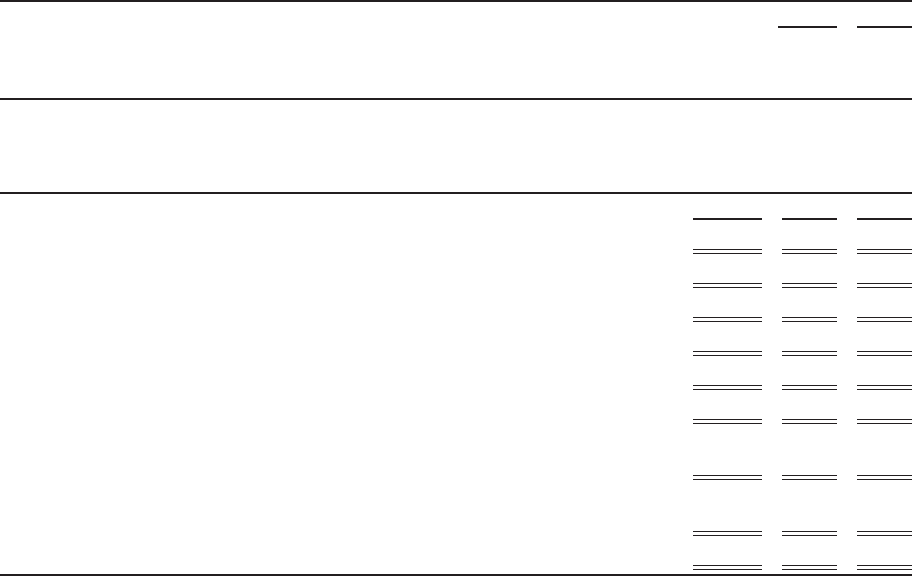

The following table presents the main classes of assets and liabilities held for sale as of December 31, 2014 and

2013:

(in thousands) 2014 2013

Cash and cash equivalents ......................................................... $—30,530

Other assets ..................................................................... 4,003 26,378

Total liabilities ................................................................... 4,003 10,333

The following table presents the summarized results of discontinued operations for the years ended

December 31, 2014, 2013 and 2012:

(in thousands) 2014 2013 2012

Total revenues .......................................................... $16,376 68,048 77,415

Income before taxes ..................................................... $13,443 1,982

Income tax (benefit) expense .............................................. $ (39) 1,388 987

Income from operating activities of discontinued operations, net of tax ........... $402,055 995

Gain on dispositions, net of tax ............................................ $48,615 ——

Income from discontinued operations, net of tax .............................. $48,655 2,055 995

Income from discontinued operations, net of tax, attributable to noncontrolling

interest .............................................................. $ 999 4,198 3,864

Income (loss) from discontinued operations, net of tax, attributable to TSYS

common shareholders .................................................. $47,656 (2,143) (2,869)

Interest allocated to discontinued operations1................................ $— 281 275

1 Interest expense relates to borrowings directly for use by Japan-based operations

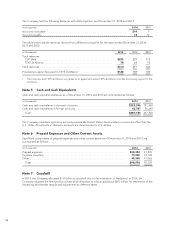

Note 3 Fair Value Measurement

GAAP requires disclosure about how fair value is determined for assets and liabilities and establishes a hierarchy

for which these assets and liabilities must be grouped, based on significant level of inputs. The three-tier fair

value hierarchy, which prioritizes the inputs used in the valuation methodologies, is as follows:

Level 1 — Quoted prices for identical assets and liabilities in active markets.

52