NetSpend 2014 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Recent Accounting Pronouncements

In April 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2014-

08 “Presentation of Financial Statements (Topic 205) and Property, Plant, and Equipment (Topic 360): Reporting

Discontinued Operations and Disclosures of Disposals of Components of an Entity.” ASU 2014-08 addresses the

accounting for the disposal of a component of an entity or a group of components of an entity. The amendments

in this Update address those issues by changing the criteria for reporting discontinued operations and enhancing

convergence of the FASB’s and the International Accounting Standard Board’s (IASB) reporting requirements for

discontinued operations. For public entities, the ASU is effective prospectively for fiscal years, and interim periods

within those years, beginning after December 15, 2014. Early adoption is permitted, but only for disposals (or

classifications as held for sale) that have not been reported in financial statements previously issued or available

for issuance. The Company elected not to early adopt ASU 2014-08. The Company does not expect the adoption

of this ASU to have a material impact on the financial position, results of operations or cash flows of the

Company.

In May 2014, the FASB issued ASU 2014-09 “Revenue from Contracts with Customers (Topic 606).” ASU 2014-09

addresses the accounting for the revenues associated with customer contracts. This Update enhances

convergence of the FASB’s and the IASB’s reporting requirements for revenue recognition. For public entities,

the ASU is effective prospectively for fiscal years, and interim periods within those years, beginning after

December 15, 2016. Early adoption is not permitted for entities applying U.S. GAAP. The Company is currently

evaluating the adoption of this ASU and its impact on the financial position, results of operations and cash flows

of the Company.

In June 2014, the FASB issued ASU 2014-12 “Compensation – Stock Compensation (Topic 718): Accounting for

Share-Based Payments When the Terms of an Award Provide That a Performance Target Could Be Achieved after

the Requisite Service Period.” ASU 2014-12 addresses the accounting for stock compensation for awards with a

performance target that could be achieved after the requisite service period. For all entities, the ASU is effective

either prospectively for share-based payment awards granted or modified on or after the effective date, or

retrospectively, using a modified retrospective approach for share based awards outstanding as of the beginning

of the earliest annual period presented in the financial statements on adoption, and to all new or modified

awards thereafter. The ASU is effective for fiscal years, and interim periods within those years, beginning after

December 15, 2015. Early adoption is permitted. The Company does not expect the adoption of this ASU to

have a material impact on the financial position, results of operations or cash flows of the Company.

In January 2015, the FASB issued ASU 2015-01 “Income Statement – Extraordinary and Unusual Items” (Subtopic

225-20): Simplifying Income Statement Presentation by Eliminating the Concept of Extraordinary Items. ASU

2015-01 eliminates from GAAP the concept of extraordinary items. For all entities, the ASU is effective for fiscal

years, and interim periods within those years, beginning after December 15, 2015. Early adoption is permitted

provided the guidance is applied from the beginning of the fiscal year of adoption. The Company does not

expect the adoption of this ASU to have a material impact on the financial position, results of operations or cash

flows of the Company.

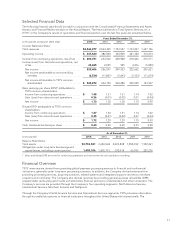

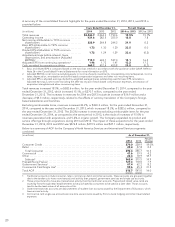

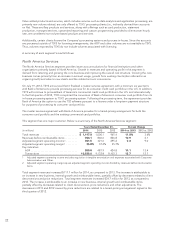

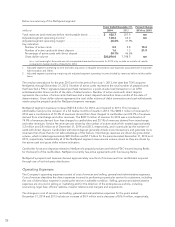

Results of Operations

Revenues

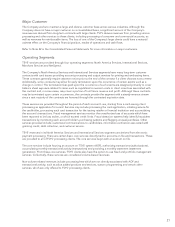

The Company generates revenues by providing transaction processing and other payment-related services. The

Company’s pricing for transactions and services is complex. Each category of revenue has numerous fee

components depending on the types of transactions processed or services provided. TSYS reviews its pricing and

implements pricing changes on an ongoing basis. In addition, standard pricing varies among its regional

businesses, and such pricing can be customized further for customers through tiered pricing of various thresholds

for volume activity. TSYS’ revenues are based upon transactional information accumulated by its systems or

reported by its customers. The Company’s revenues are impacted by currency translation of foreign operations,

as well as doing business in the current economic environment.

The Company has included reimbursements received for out-of-pocket expenses as revenues and expenses. The

largest reimbursable expense item for which TSYS is reimbursed by clients is postage. The Company’s

18