NetSpend 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.not have standalone value. For these arrangements, conversion or implementation services that do not have

standalone value, are recognized over the expected customer relationship (contract term) as the related

processing services are performed.

The Company’s other services generally have standalone value and constitute separate units of accounting for

revenue recognition purposes. Customer arrangements entered into prior to 2011 (prior to the adoption of

Accounting Standard Update (ASU) 2009-13, “Multiple-Deliverable Revenue Arrangements,” an update to ASC

Topic 605, “Revenue Recognition,” and formerly known as EITF 08-1, “Revenue Arrangements with Multiple

Deliverables”) often included services for which sufficient objective and reliable evidence of fair value did not

exist. In these situations, the deliverables were combined and recognized as a single unit of accounting based on

the proportional performance for the combined unit. For pre-2011 arrangements that have not expired, have not

been materially modified or amended, or terminated, the Company continues to recognize revenue in

accordance with these policies in the accompanying financial statements. Beginning in 2011, services in new or

materially modified arrangements of this nature were divided into separate units of accounting and revenue is

now allocated to each unit of accounting based on the relative selling price method as disclosed above. As the

services in the pre-2011 arrangements are generally delivered over the same term with consistent patterns of

performance, there is no difference in the timing or pattern of revenue recognition for each group of

arrangements (pre-2011 arrangements and those new or materially modified thereafter).

The Company’s multiple element arrangements may include one or more elements that are subject to other

topics including software revenue recognition and leasing guidance. The consideration for these multiple

element arrangements is allocated to each group of deliverables – those subject to ASC 605-25 and those

subject to other topics based on the revised guidance in ASU 2009-13. Arrangement revenue for each group of

deliverables is then further separated, allocated, and recognized based on applicable guidance.

The Company’s NetSpend revenues principally consist of a portion of the service fees and interchange revenues

received by the Issuing Banks in connection with the programs NetSpend manages. Revenue is recognized when

there is persuasive evidence of an arrangement, the relevant services have been rendered, the price is fixed or

determinable and collectability is reasonably assured.

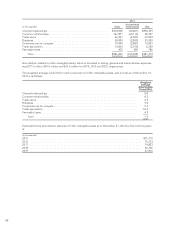

Cardholders are charged fees in connection with NetSpend’s products and services as follows:

• Transactions — Cardholders are typically charged a fee for each PIN and signature-based purchase

transaction made using their GPR cards, unless the cardholder is on a monthly or annual service plan, in

which case the cardholder is instead charged a monthly or annual subscription fee, as applicable.

Cardholders are also charged fees for ATM withdrawals and other transactions conducted at ATMs.

• Customer Service and Maintenance-Cardholders are typically charged fees for balance inquiries made

through NetSpend’s call centers. Cardholders are also charged a monthly maintenance fee after a specified

period of inactivity.

• Additional Products and Services-Cardholders are charged fees associated with additional products and

services offered in connection with certain GPR cards, including the use of overdraft features, a variety of bill

payment options, custom card designs and card-to-card transfers of funds initiated through the call centers.

• Other-Cardholders are charged fees in connection with the acquisition and reloading of the GPR cards at

retailers and the Company receives a portion of these amounts in some cases.

Revenue resulting from the service fees charged to the cardholders described above is recognized when the fees

are charged because the earnings process is substantially complete, except for revenue resulting from the initial

activation of cards and annual subscription fees. Revenue resulting from the initial activation of cards is

recognized ratably, net of commissions paid to distributors, over the average account life, which is approximately

six months for GPR cards. Revenue resulting from annual subscription fees is recognized ratably over the annual

period to which the fees relate.

Revenues also include fees charged in connection with program management and processing services the

Company provides for private-label programs. Revenue resulting from these fees is recognized when the

Company has fulfilled its obligations under the underlying service agreements.

49