NetSpend 2014 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cash Used in Acquisitions

In 2014, the Company paid $38.6 million to NetSpend dissenting shareholders to settle the outstanding lawsuit

associated with the NetSpend acquisition. In 2013, the Company used cash of $1.3 billion in the acquisition of

NetSpend. In 2012, the Company used cash of $188.7 million in the acquisitions of ProPay and CPAY. Refer to

Note 24 in the Consolidated Financial Statements for more information on these acquisitions.

Licensed Computer Software from Vendors

Expenditures for licensed computer software from vendors for increases in processing capacity were $29.6 million

in 2014, compared to $63.6 million in 2013 and $33.0 million in 2012. The increase in expenditures in 2013 was

driven by purchases of software in anticipation of large conversions in 2014 and beyond.

Purchase of Private Equity Investments

In 2011, the Company entered into a limited partnership agreement in connection with its agreement to invest in

an Atlanta, Georgia-based venture capital fund focused exclusively on investing in technology-enabled financial

services companies. Pursuant to the limited partnership agreement, the Company has committed to invest up to

$20 million in the fund so long as its ownership interest in the fund does not exceed 50%. The Company made

investments in the fund of $3.3 million, $1.4 million and $3.0 million in 2014, 2013 and 2012, respectively. The

Company recorded gains on this investment of $793,000, $966,000 and $898,000 for the years ended

December 31, 2014, 2013 and 2012, respectively.

Proceeds from Insurance Recovery for Loss on Disposal

The Company received $6.2 million of proceeds from insurance coverage related to the destruction of property

resulting from a fire. The Company recorded the loss on disposal which was more than offset by the insurance

proceeds received.

Proceeds from Dispositions

During 2014, TSYS sold its Japan-based operations and received $45.0 million of proceeds, net of expenses paid

and cash disposed in connection with this transaction. Refer to Note 2 in the Consolidated Financial Statements

for more information on discontinued operations.

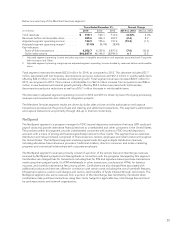

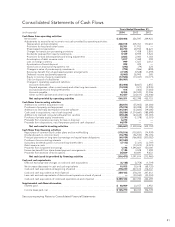

Cash Flows from Financing Activities

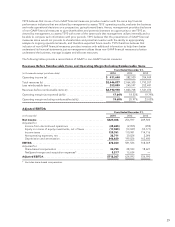

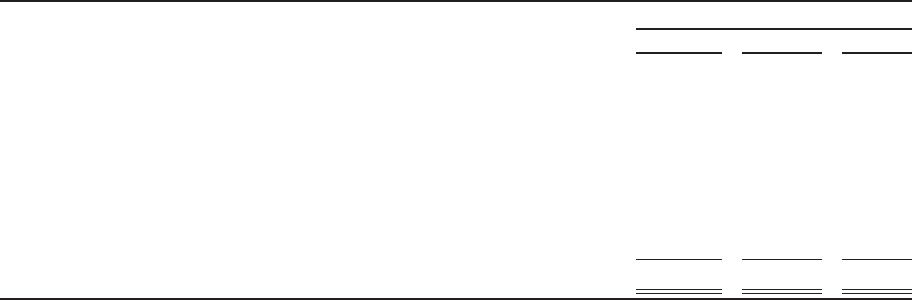

Years Ended December 31,

(in thousands) 2014 2013 2012

Repurchase of common stock under plans and tax withholding ............ $(170,516) (103,857) (74,939)

Dividends paid on common stock .................................... (74,796) (56,510) (94,035)

Principal payments on long-term borrowings and capital lease obligations . . (69,939) (166,805) (200,052)

Purchase of noncontrolling interest ................................... (37,500) ——

Subsidiary dividends paid to noncontrolling shareholders ................ (7,172) (7,321) (2,797)

Debt issuance costs ................................................ —(13,573) (2,073)

Proceeds from long-term borrowings ................................. 1,396 1,395,661 150,000

Excess tax benefit from share-based payment arrangements .............. 7,185 3,528 1,259

Proceeds from exercise of stock options ............................... 34,869 40,691 9,672

Net cash (used in) provided by financing activities ....................... $(316,473) 1,091,814 (212,965)

The main source of cash from financing activities has been the use of borrowed funds. The major uses of cash for

financing activities have been the purchase of stock under the stock repurchase plan as described below,

payment of dividends, principal payment on long term debt and capital lease obligations, and purchase of

noncontrolling interests. Net cash used in financing activities for the year ended December 31, 2014 was

$316.5 million and was primarily the result of the repurchase of common stock, payment of dividends, and

32