NetSpend 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

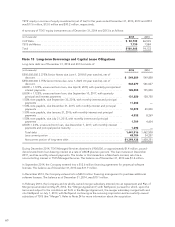

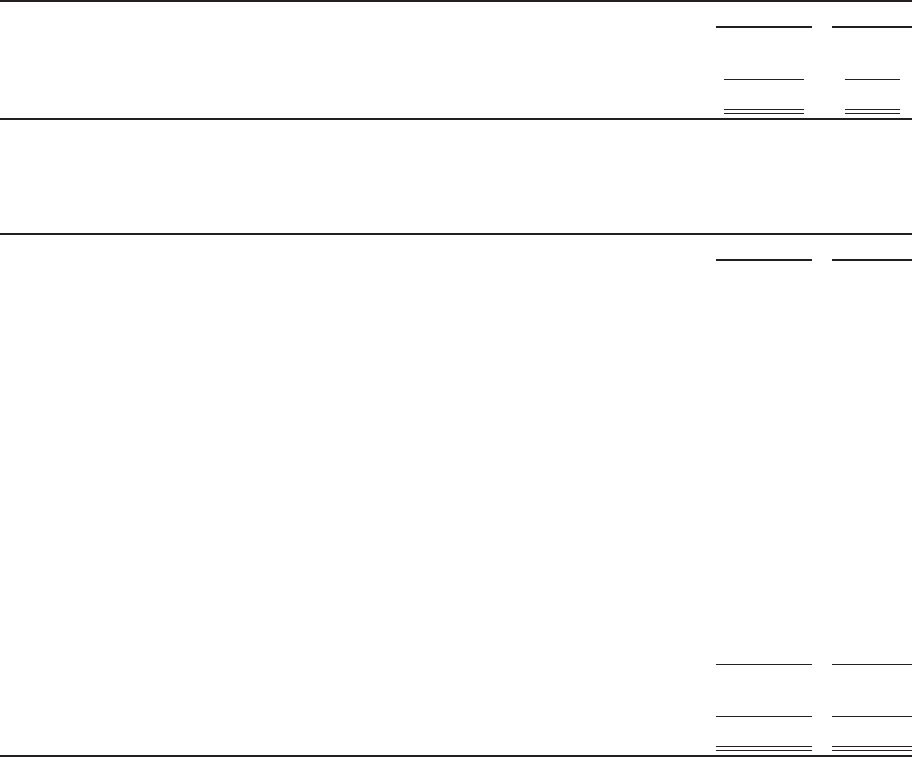

TSYS’ equity in income of equity investments (net of tax) for the years ended December 31, 2014, 2013 and 2012

was $17.6 million, $13.0 million and $10.2 million, respectively.

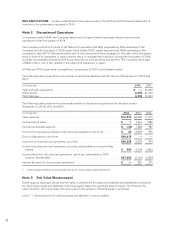

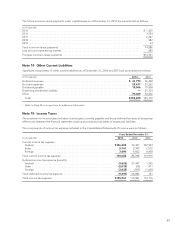

A summary of TSYS’ equity investments as of December 31, 2014 and 2013 is as follows:

(in thousands) 2014 2013

CUP Data ................................................................. $ 92,738 86,549

TSYS de México ........................................................... 7,730 7,584

Total .................................................................... $100,468 94,133

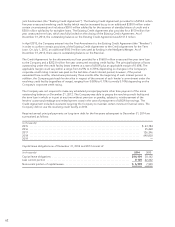

Note 13 Long-term Borrowings and Capital Lease Obligations

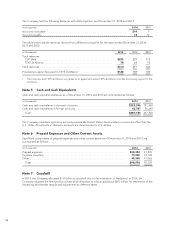

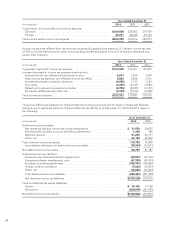

Long-term debt as of December 31, 2014 and 2013 consists of:

(in thousands) 2014 2013

$550,000,000 2.375% Senior Notes due June 1, 2018 (5 year tranche), net of

discount ................................................................ $ 549,889 549,858

$550,000,000 3.75% Senior Notes due June 1, 2023 (10 year tranche), net of

discount ................................................................ 546,379 546,027

LIBOR + 1.125%, unsecured term loan, due April 8, 2018, with quarterly principal and

interest payments ........................................................ 185,000 195,000

LIBOR + 1.125%, unsecured term loan, due September 10, 2017, with quarterly

principal and interest payments ............................................ 131,250 138,750

1.50% note payable, due September 30, 2016, with monthly interest and principal

payments ............................................................... 11,886 —

1.50% note payable, due December 31, 2015, with monthly interest and principal

payments ............................................................... 10,075 20,000

1.50% note payable, due January 31, 2016, with monthly interest and principal

payments ............................................................... 4,332 8,269

1.50% note payable, due July 31, 2015, with monthly interest and principal

payments ............................................................... 1,709 4,604

LIBOR + 2.0%, unsecured term loan, due December 7, 2017, with monthly interest

payments and principal paid at maturity ..................................... 1,396 —

Total debt .............................................................. 1,441,916 1,462,508

Less current portion ...................................................... 43,784 34,257

Noncurrent portion of long-term debt ....................................... $1,398,132 1,428,251

During December 2014, TSYS Managed Services obtained a £900,000, or approximately $1.4 million, pound-

denominated term loan bearing interest at a rate of LIBOR plus two percent. The loan matures in December

2017, and has monthly interest payments. The lender in this transaction is Merchants Limited, who has a

noncontrolling interest in TSYS Managed Services. The balance as of December 31, 2014 was $1.4 million.

In September 2014, the Company entered into a $13.6 million financing agreement for perpetual software

licenses. The balance as of December 31, 2014 was $11.9 million.

In December 2013, the Company entered into a $20.0 million financing arrangement to purchase additional

software licenses. The balance as of December 31, 2014, was $10.1 million.

In February 2013, the Company and its wholly-owned merger subsidiary entered into an Agreement and Plan of

Merger (as amended on May 29, 2013, the “Merger Agreement”) with NetSpend, pursuant to which, upon the

terms and subject to the conditions set forth in the Merger Agreement, the merger subsidiary merged with and

into NetSpend on July 1, 2013, with NetSpend continuing as the surviving corporation and as a wholly-owned

subsidiary of TSYS (the “Merger”). Refer to Note 24 for more information about the acquisition.

60