NetSpend 2014 Annual Report Download - page 47

Download and view the complete annual report

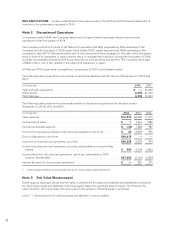

Please find page 47 of the 2014 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Given its history of acquisitions, TSYS may allocate part of the purchase price of future acquisitions to contingent

consideration as required by GAAP for business combinations. The fair value calculation of contingent

consideration will involve a number of assumptions that are subjective in nature and which may differ significantly

from actual results. TSYS may experience volatility in its earnings to some degree in future reporting periods as a

result of these fair value measurements.

CASH AND CASH EQUIVALENTS: Cash on hand and investments with a maturity of three months or less

when purchased are considered to be cash equivalents.

ACCOUNTS RECEIVABLE: Accounts receivable balances are stated net of allowances for doubtful accounts

and billing adjustments.

TSYS records an allowance for doubtful accounts when it is probable that the accounts receivable balance will not

be collected. When estimating the allowance for doubtful accounts, the Company takes into consideration such

factors as its day-to-day knowledge of the financial position of specific clients, the industry and size of its clients,

the overall composition of its accounts receivable aging, prior history with specific customers of accounts

receivable write-offs and prior experience of allowances in proportion to the overall receivable balance. This

analysis includes an ongoing and continuous communication with its largest clients and those clients with past

due balances. A financial decline of any one of the Company’s large clients could have a material adverse effect

on collectability of receivables and thus the adequacy of the allowance for doubtful accounts.

Increases in the allowance for doubtful accounts are recorded as charges to bad debt expense and are reflected

in selling, general and administrative expenses in the Company’s Consolidated Statements of Income. Write-offs

of uncollectible accounts are charged against the allowance for doubtful accounts.

TSYS records an allowance for billing adjustments for actual and potential billing discrepancies. When estimating

the allowance for billing adjustments, the Company considers its overall history of billing adjustments, as well as

its history with specific clients and known disputes. Increases in the allowance for billing adjustments are

recorded as a reduction of revenues in the Company’s Consolidated Statements of Income and actual

adjustments to invoices are charged against the allowance for billing adjustments.

UP-FRONT DISTRIBUTOR PAYMENTS: The Company makes up-front contractual payments to third-party

distribution partners. The Company assesses each up-front payment to determine whether it meets the criteria of

an asset as defined by U.S. GAAP. If these criteria are met, the Company capitalizes the up-front payment and

recognizes the capitalized amount as expense ratably over the benefit period, which is generally the contract

period. If the contract requires the distributor to perform specific acts (i.e. achieve a sales goal) and no other

conditions exist for the distributor to earn or retain the up-front payment, then the Company capitalizes the

payment and recognizes it as an expense when the performance conditions have been met. Up-front distributor

payments are classified on the Consolidated Balance Sheet as other non-current assets and recorded as a cost of

services in the Consolidated Statements of Income.

PROPERTY AND EQUIPMENT: Property and equipment are stated at cost less accumulated depreciation and

amortization. Depreciation and amortization are computed using the straight-line method over the estimated

useful lives of the assets. Buildings and improvements are depreciated over estimated useful lives of 5-40 years,

computer and other equipment over estimated useful lives of 2-5 years, and furniture and other equipment over

estimated useful lives of 3-15 years. The Company evaluates impairment losses on long-lived assets used in

operations in accordance with the provisions of GAAP. All ordinary repairs and maintenance costs are expensed

as incurred. Maintenance costs that extend the asset life are capitalized and amortized over the remaining

estimated life of the asset.

LICENSED COMPUTER SOFTWARE: The Company licenses software that is used in providing services to

clients. Licensed software is obtained through perpetual licenses and site licenses and through agreements

based on processing capacity (called “MIPS agreements”). Perpetual and site licenses are amortized using the

straight-line method over their estimated useful lives which range from three to ten years. Software licensed

under MIPS agreements is amortized using a units-of-production basis over the estimated useful life of the

software, generally not to exceed ten years. At each balance sheet date, the Company evaluates impairment

losses on long-lived assets used in operations in accordance with GAAP.

44